| |

What is the impact of Brexit?

Brexit immediately reduced the 15-year gilt yields from 1.93% just before the EU Referendum to an all time record low of 0.90% on 11 August 2016, after the Bank of England reduced interest rates to 0.25% and announced more quantitative easing buying £60 billion of UK government gilts and £10 billion of corporate bonds.

The reason for the fall at the time was uncertainty over the UK economy as a result of Brexit as investors seek safe havens in bonds and gilts driving the price higher and yields lower.

Annuity rates are mainly based on these gilt yields and a fall of 103 basis points would usually result in a decrease in annuities by 10.3% at some point from providers.

Since Brexit annuity rates have recovered on average by 55% with 15-year gilt yields at about 5.03%.

Annuity income is at a sixteen year high by April 2025 and are likely to remain higher for longer. This could be the ideal opportunity to lock-in secure income for the future.

Review your options at State pension age

Using a more flexible retirement plan such as a fixed term annuity would allow you to avoid economic uncertainty and allow the opportunity for markets to recover in the future.

If you are yet to receive your State pension selecting a term after this date, usually age 65 to 66, would be an ideal time to review your circumstances.

What is a flexible drawdown plan?

Flexible income drawdown is an alternative to buying a lifetime annuity since April 2015 as you can now take benefits from your pension for anyone aged 55 years more.

These plans are also known as pension drawdown, income drawdown or now as flexi-access drawdown.

In particular for funds larger than £30,000 it will be possible to take the full fund as cash less tax at your marginal rate. This allows you to take your tax free lump sum and

and leave the remaining fund which you can access easily as an income or single payments.

There is no limit to the amount you can take other than the level of tax you would pay. If you have a capped drawdown plan you are still limited to 150% GAD (government actuaries department) or about 50% more than an annuity.

It is ideally suited for those that would like to avoid buying an annuity with the opportunity to leave the fund to a

dependant, nominee or successor on the death, possibly free from tax or marginal rate of tax in most cases from 2016/17 tax year.

What are the advantages

|

Ideal for smaller funds from £30,000 and more. |

| |

|

|

Take your tax free lump sum now. |

| |

|

|

Easy access to your full fund as income or single lump sums at any time. |

| |

|

|

Take your whole fund as a cash sum less tax at your marginal rate. |

| |

|

|

Leave the fund in a secure cash fund or select a smoothed growth fund with a 5% to 6% return and low volatility. |

| |

|

|

Low cost structures with no extra charges for withdrawals. |

| |

|

|

Contribute to the plan and receive tax relief at your marginal rate or £3,600 pa if you have no taxable earnings. |

| |

|

|

The fund, in the event of early death, can be transferred to your dependant, nominee or successor. |

| |

|

|

You can consider your options at any time, including a lifetime annuity, fixed term plan or any other option available. |

| |

|

|

You can move your fund to any other flexi-access drawdown at any time without penalty if you are offered better terms. |

| |

|

|

Avoid buying a lifetime annuity now when rates are near an all time low. |

| |

|

|

You do not have to give your capital away to an insurance company in exchange for an income. |

|

Popular options taken by people now

People retiring now can select the following:

| • |

flexi-access drawdown |

| • |

Capped drawdown |

Flexi-access drawdown allows an individual to take an unlimited level of income from the plan. Although you can contribute to a pension you are limited to £10,000 each year with tax relief.

Capped drawdown is limited to

150% GAD and is no longer available but all existing plans can continue. You can also contribute to the pension in the same tax year, especially useful if you are still working and can benefit from tax relief as the allowance is £40,000 each year.

The income taken from flexi-access drawdown depends on the need for income in the future or intention to take a cash sum but the usual options are as follows:

|

Take full fund - The fund can be taken over two or more years to minimise your tax liability. |

| |

|

|

Maximum income - Take enough each year to last your lifetime or until age 105. |

| |

|

|

Similar to an annuity - Match the income from a lifetime annuity. |

| |

|

|

£Nil regular income - Allow the fund to grow taking cash lump sums when you need it. |

| |

|

The income can be taken monthly, quarterly, half yearly, annually or ad hoc as single withdrawal as and when required.

Leave the fund to your family

The pension rules were changed from 6 April 2015 to allow greater flexibility to leave a flexi-access drawdown to

dependant, nominee or successor on the death of the member. This means the pension can also be left to a beneficiary that is not a dependant.

The tax position depends whether death occurs before or after the age of 75 and if your pension fund is uncrystallised (not taken) or crystallised where you have taken a tax free lump sum and flexi-access drawdown. The following is a summary of the tax payable for the different scenarios.

| Drawdown death benefits |

| Situation on death |

Die before 75 |

Die after 75 |

No benefits taken,

fund taken as lump sum |

Tax Free |

Marginal *

income tax |

In flexi-access drawdown,

fund taken as lump sum |

Tax Free |

Marginal *

income tax |

| In flexi-access drawdown, fund taken as income |

Tax Free |

Marginal

income tax |

| * Changes to marginal rate from 2016/17 tax year. |

|

|

The advantage of flexi-access drawdown is the fund can be left to a dependant and thereafter to a successor such as children and in some circumstances tax free.

How are your funds invested

Funds in flexible income drawdown can be invested in different ways such as cash, smoothed growth or fully invested and this depends on your attitude to risk and the time period you intend to leave the funds in drawdown.

Cash is low risk and currently produces low interest of about 0.5% per year, smoothed growth is defensive offering 4.0% per year which is added daily and fully invested is volatile falling and increasing daily but with higher potential returns of 4-5% per year.

Investment volatility in retirement makes it difficult to take a regular income as sometimes the fund value is low and you need to cash-in more units to pay the same income. Therefore low volatility in funds reduces this risk and it is possible to achieve low volatility and higher returns than cash by using a smoothed growth fund.

The following table shows the volatility and expected return for cash, a smoothed growth fund and invested equity portfolio.

| Drawdown volatility and return |

| fund Type |

Volatility * |

Expected Return |

|

0 |

0.5% |

|

2 |

4.0% |

|

45 |

4-5% |

| * Volatility is a measure of how value goes up and down compared to the FTSE-100 index with a volatility figure of 100. |

|

|

The low volatility of the protected growth fund would offer is due to the funds expected growth rate being added daily to your fund. This produces a smoothed return and more certainty that income can be taken without the same volatility as an invested equity portfolio and better return than a cash fund. This is particularly the case where the time frame for the drawdown is short, say two or three years.

|

Pension drawdown rates

The following flexi-access drawdown tables assumes a pension fund of £100,000 net of the £33,333 taken as a tax free lump sum from an original fund of £133,333.

The table below is the highest annuity rates on a standard 100% joint life, level with no guarantee basis and the drawdown plan is based on a couple of the same age where the surviving partner lives to age 97. The income for drawdown is the maximum that can be taken for the fund to be depleted by 97 years of age.

The table shows the increase or decrease in annual income from a drawdown plan when compared to the highest standard pension annuity.

Fund size: £100,000 (after taking £33,333

tax free cash)

FTSE 15-year gilt yield: 1.50% (1 January 2019)

Last updated: 1 October 2016

| Annuity vs Flexi-access Drawdown |

| Age |

100% Joint

Life Annuity |

Drawdown |

More/Less |

| 55 |

|

|

|

£1,570 |

|

|

| 60 |

|

|

|

£1,400 |

|

|

| 65 |

|

|

|

£1,330 |

|

|

| 70 |

|

|

|

£1,300 |

|

|

| 75 |

|

|

|

£1,290 |

|

|

| The annual rates

shown above are based on a purchase price of £100,000

and should be used as a guide only. Pension drawdown assumes a 4.0% fund growth after charges. Pension drawdown is a higher risk pension than annuities and not suitable for everyone. For a drawdown rate specific to your circumstances you should complete

the flex-access drawdown quote. |

|

|

As the spouse will receive the drawdown fund on death, the basis for the comparative annuity shows the spouse receiving the same benefits as the annuitant.

For the above example the annuity is a 100% joint life, level, no guaranteed period, monthly advance annuity where both the male annuitant and female dependant are the same age.

As you can see from the table the income figure for flex-access drawdown at ages 55 is £4,800, whereas at age 75, this has risen to £6,600. This is the maximum amount that can be taken out of the fund where the objective is to deplete the fund assuming the surviving partner lives to 97 years of age.

The drawdown is based on a smoothed growth with a fund growth of 4.0% after charges. Income is added to the fund on a daily basis producing low volatility.

What you could receive back

Flexible drawdown access offers a low risk sterling based cash fund or low to medium risk smoothed growth fund. Depending on your attitude to risk and the level of risk you are happy to take will determine the size of fund you can have in the future.

However, where you want growth in the fund there is always the risk that the fund can go down as well as up, even when smoothed, although with much less volatility than actual equity markets.

As an example, a 60 year with a fund of £133,333.34 could take a tax free lump sum now leaving £100,000 for drawdown. An income can be taken from £Nil with no maximum and this compares to a lifetime annuity of £3,640 pa based on a 100% joint life payable monthly in advance.

1 - Smoothed growth plans

Drawdown access allows the fund to be placed in cash, smoothed growth or equity funds. To reduce risk but achieve growth a smoothed growth fund should be considered.

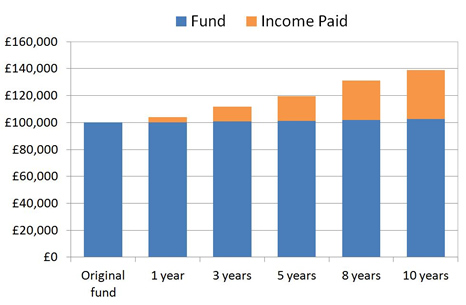

The following shows a smoothed growth fund taking an income of £3,640 pa to match the annuity over different durations from 1 year to 10 years. The growth after charges is 4.0% per year which is added the the fund on a daily basis providing a very low level of volatility for a growth fund.

|

| Source: Sharingpensions.co.uk research for a 60 year old with a fund of £100,000. Combination of fund and income paid of £3,640 pa. |

To take the whole fund as cash would mean paying higher rate tax and in most cases people would be willing to pay only basic rate tax. This would mean taking the fund over several tax years and for those people that would classify themselves as low-medium risk investors could consider a smoothed fund.

2 - Comparing growth and cash based plans

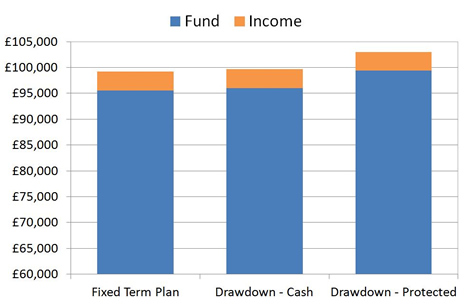

The following chart compares a short term of one year for the fixed term plan with drawdown in a cash fund and smoothed growth fund.

|

| Source: Sharingpensions.co.uk research for a 60 year old with a fund of £100,000. Combination of fund and income paid of £3,640 pa. |

All options in this example provide an income of £3,640 pa and after set-up charges the fixed term plan returns the fund and income of £99,200. The drawdown cash fund returns the fund and income of £99,670 and the drawdown smoothed growth could potentially return the fund plus the income of £103,020.

Find out how much you can receive from the highest standard annuity, either complete our quote form or call 020 8801 5856 today.

About Sharing Pensions

Sharingpensions.co.uk was created by its founder Colin Thorburn in 2001 to provide a free pensions and annuity resource to hundreds of thousands of people at retirement making their decision making easier and to select the best options.

Colin Thorburn has nineteen years experience in pensions and annuities, is an individual authorised by the Financial Conduct Authority and business is submitted through Blackstone Moregate Ltd which is authorised and regulated by the FCA (no. 459051).

|