| |

What is the impact of Brexit?

Brexit immediately reduced the 15-year gilt yields from 1.93% just before the EU Referendum to an all time record low of 0.90% on 11 August 2016, after the Bank of England reduced interest rates to 0.25% and announced more quantitative easing buying £60 billion of UK government gilts and £10 billion of corporate bonds.

The reason for the fall at the time was uncertainty over the UK economy as a result of Brexit as investors seek safe havens in bonds and gilts driving the price higher and yields lower.

Annuity rates are mainly based on these gilt yields and a fall of 103 basis points would usually result in a decrease in annuities by 10.3% at some point from providers.

Since Brexit annuity rates have recovered on average by 55% with 15-year gilt yields at about 5.03%.

Annuity income is at a sixteen year high by April 2025 and are likely to remain higher for longer. This could be the ideal opportunity to lock-in secure income for the future.

Review your options at State pension age

Using a more flexible retirement plan such as a fixed term annuity would allow you to avoid economic uncertainty and allow the opportunity for markets to recover in the future.

If you are yet to receive your State pension selecting a term after this date, usually age 65 to 66, would be an ideal time to review your circumstances.

What is a fixed term plan?

A fixed term annuity is a low risk option giving you the opportunity to avoid buying a lifetime annuity while offering certainty of income and a guaranteed fund at the end of the term. If you are prepared to accept more risk you can consider flexi-access drawdown.

Recent changes to pension rules will allow the a tax free lump sum to be taken less marginal rate tax. For a fixed term annuity the remainder of the fund is in a tax efficient pension plan

where you can receive a guaranteed fund at the end of the term.

Income can be taken with a term of one year and more with the option of taking the maximum income to deplete the fund over the desired term. Or you can receive a guaranteed maturity value at the end of the term by taking a lower income from the plan.

Some providers include a flexible cash account to the plan if you select a five year term allowing you to vary the income if your circumstances change in the future. While in the cash account your money remains in the pension and would not be taxed until you decide to take the income.

At the end of the term all your options are available with the choice of buying another fixed term annuity, a lifetime annuity or flexi-access drawdown from any provider.

The underlying assets are invested in gilts and corporate bonds offering a guaranteed return to the end of the term. There is no investment risk and the return improves with longer terms of 5 to 10 years which are generally between 2.0% to 2.5% per year.

Main advantages of the plan

|

Avoid buying an annuity while rates are at an all time low following the Brexit shock for people at retirement. |

| |

|

|

Take your tax free lump sum now. |

| |

|

|

Popular terms are 1, 3, 5 and 10 years although any number of years is possible. |

| |

|

|

Select an income suitable for your needs from £nil up to any amount. |

| |

|

|

Flexible cash account on 5-year term plans to allow you to vary the income if your circumstances change in the future. |

| |

|

|

Take your full fund over two or more years to minimise your tax liability. |

| |

|

|

Offers the flexibility to consider your options again such as a lifetime annuity, fixed term annuity or drawdown. |

| |

|

|

Receive a guaranteed maturity value (GMV) at the end of the term. |

| |

|

|

Move the fund to any provider without charge at the end of the term. |

| |

|

|

Your fund is invested in government gilts and not exposed to investment risk. |

| |

|

|

You can add protection to the plan in the event of early death to ensure it is transferred to your spouse or beneficiaries. |

| |

|

|

You do not have to give your capital away to an insurance company in exchange for an income. |

What can you do with the fund

There are four popular strategies with a fixed term annuity to give you income and/or a guaranteed maturity value over time as follows:

|

Take full fund - Take the maximum income for a number of years with no guaranteed maturity value. |

| |

|

|

Similar annuity income - Match the income from a lifetime annuity for a specific period of time. |

| |

|

|

Specific income - Decide on a specific income you will need over the term you select. |

| |

|

|

£Nil regular income - After taking your tax free cash with no regular income and delay a decision until a later date. |

| |

|

By remaining in a pension environment the fund benefits from tax free growth

from the maturity value and guaranteed returns of 2.0% to 2.5% per year for longer term plans.

|

Flexible cash account

Some providers of fixed term plans include a cash account for 5-year term plans offering greater flexibility where you choose to select an income. This will give you the opportunity to reduce the level of income you take should your circumstances change in the future.

If in the future you started working part time, sold a property, cash-in an investment or received an inheritance

and did not require the income at that time, the income from the fixed term plan can be directed to the cash account.

As soon as income is paid to you marginal tax would be deducted, however, if placed in the cash account the income remains in a pension without a tax deduction. At a later date you could take part or the full amount remaining in this account and pay marginal rate tax at that time.

If you decided to set-up the fixed term plan on a £Nil income basis, it may be more useful to take an income and place this in the cash account to give you the flexibility to access funds during the fixed term if needed.

How much can you get back

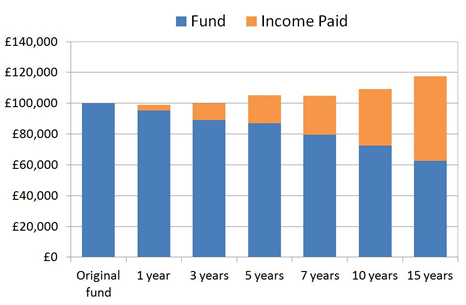

The fixed term plan can be run for different terms from one year onwards and typically up to age 75. The chart below shows how the income and guaranteed maturity value at the end of the term can vary with different terms from one year to 15 years.

As an example, a 60 year with a fund of £133,333.34 could take a tax free lump sum now leaving £100,000 for a fixed term plan and this compares to a lifetime annuity of £3,640 pa based on a 100% joint life payable monthly in advance.

|

| Source: Sharingpensions.co.uk research for a 60 year old with a fund of £100,000 on a 100% joint life and monthly in advance. Combination of GMV at the end of the term and income of £3,640 pa paid over different terms. |

The chart is compared to a lifetime annuity of £3,640 pa based on single life with 100% value protection payable monthly in advance. You must decide at the start how much income you need fro no income and there is no maximum.

For the fixed term plan, the total return varies and improves with longer terms from 5.0% over five years, 9.0% over ten years to 17.3% over fifteen years.

Over a five year term the total value would reach £105,061 and pay total income from this of £18,200 leaving a residual fund of £86,861.

Annuities to rise with interest rates

With the fixed term annuity you do not need to commit to a lifetime annuity now when rates are low and expected to rise. Rates are based

on the 15-year gilt yields and these increase with rising interest rates.

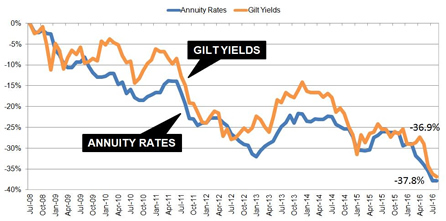

The following chart shows how annuity rates have reduced and closely followed gilt yields since the financial crisis.

|

| Source: Sharingpensions.co.uk research based on annuity rates and gilt yields in July 2008 and the changes over time and recent improvements. |

A rise in interest rates would increase the 15-year gilt yields and also annuity rates. As a rough guide if interest rates increase by 1.5% annuity rates are likely to increase by 15%.

Flexibility to meet your needs

The fixed term annuity can be be structured to meet your needs for a period of time selected by you from one year onwards with all the open market options available to you at the end of the term. The fund you receive at the end of the term or guaranteed maturity value is known at the outset so there is no investment risk with this plan.

On your early death, the fund can be passed to a spouse receiving the GMV at the end of the term which can be used to buy another fixed term plan, lifetime annuity or flexi-access drawdown or taken as a cash sum less tax.

This compares with the lifetime annuity that cannot be changed once it is set-up. A fixed term annuity allows you to exit the plan at any time and for any reason to purchased a lifetime standard or impaired annuity.

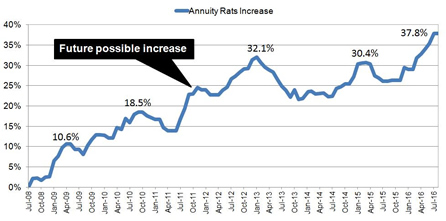

Annuity rates are based on the 15-year gilt yields which have reduced due to the low interest rates after the financial crisis. The following chart shows how annuity rates have changed since July 2008 at the start of the financial crisis and the gap now showing annuity rates could increase.

|

| Source: Sharingpensions.co.uk research based on gilt yields at July 2008 of 4.83% compared to annuities and expected change as the economy recovers |

Apart from rising annuity rates you could also benefit from any poor health in the future. The problem with a lifetime annuity is locking into a level of income when you are healthy and being unable to change this in the future should your circumstances change.

After the age of 70 the people are much more likely to have medical conditions and it is common to have high blood pressure, Cholesterol, diabetes or a heart condition. This could further increase the annuity income by 20% and a combination rising annuity rates and impaired health could result in 40% more income from a lifetime annuity.

Find out how much you can receive from the highest standard annuity, either complete our quote form or call 020 8801 5856 today.

|

About Sharing Pensions

Sharingpensions.co.uk was created by its founder Colin Thorburn in 2001 to provide a free pensions and annuity resource to hundreds of thousands of people at retirement making their decision making easier and to select the best options.

Colin Thorburn has nineteen years experience in pensions and annuities, is an individual authorised by the Financial Conduct Authority and business is submitted through Blackstone Moregate Ltd which is authorised and regulated by the FCA (no. 459051).

|