|

19 July 2019 last updated |

|

| Annuity rates fall as Federal Reserve expected to reduce interest rates |

|

| |

Providers reduce annuity rates by -4.40% following a 42 basis point fall in 15-year gilt yields. |

|

|

|

|

|

Providers lower annuity rates with gilt yields continuing to slide as investors expect US Federal Reserve to reduce interest rates by 25 basis points by the end of July.

Providers have lowered annuities with the standard annuity rates falling by -4.40% and the 15-year gilt yields reducing 42 basis points since the start of May.

The US Federal Reserve has signaled interest rates to reduced by a 25 basis points in the next meeting on 30-31 July. Investors are anticipating central banks to adopt a softer monetary policy as the global economy is under greater pressure of a slowdown. There are moves in the US Federal Reserve and the European Central Bank (ECB) to appoint more dovish members.

European leaders have nominated Christine Lagarde to succeed Mario Draghi as the next president of the ECB and investors expect her to continue similar soft policies on interest rates.

|

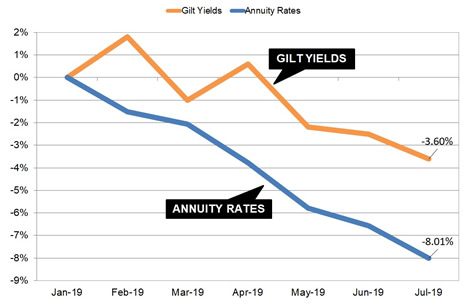

| Fig 1: Chart comparing standard annuity rates and 15-year gilt yields |

The chart shows annuity rates for 2019 which are down -8.01% for the year so far compared to the 15-year gilt yields that are lower by -3.60%. Annuity rates are based on the movement of 15-year gilt yields and in the long term you would expect providers to correct the difference by raising annuities by about 4.41%.

Changes in the chart are based on our benchmark example of a person aged 65 year old with a £100,000 fund at the beginning of the year, they could purchase an annuity on a single life, level basis with income of £5,571 pa. This has reduced by £446 pa to the middle of July with an income of £5,125 pa.

In terms of total income during their life, the Office of National Statistics (ONS) would expect a male to live for 18.5 years and he will have -£8,251 less over his lifetime. For a female she can expected to live for 20.9 years decreasing her lifetime income by -£9,321.

| |

Annuity rates and gilt yields |

|

| |

Jan |

Feb |

Mar |

Apr |

May |

Jun |

Jul |

| Rate |

£5,571 |

£5,487 |

£5,456 |

£5,361 |

£5,249 |

£5,205 |

£5,125 |

| Yield |

1.43% |

1.61% |

1.33% |

1.49% |

1.21% |

1.18% |

1.07% |

|

The above table shows the volatility in the 15-year gilt yields over the last 6 months with a range from 1.61% to 1.07%. Yields reduced to a record low of 0.90% in August 2016 after the EU referendum with providers lowering annuity income to an all time low of £4,696 pa in the same month.

Investors are also concerned that the UK has moved closer to a no-deal Brexit. Comments made by Boris Johnson has made suggestion he is elected as Prime Minister later in July, he is willing to abandon the Irish backstop increasing the likelihood of the UK leaving the EU without a trade deal.

There could be more falls in gilt yields in the next few months based on action taken by central banks, the global economy and Brexit which could see annuity rates remaining at the current low levels.

|

| |

|

|

|

|

|

|

|

| |

Age |

Single |

Joint |

|

|

| |

55 |

£6,132 |

£5,784 |

|

|

| |

60 |

£6,532 |

£6,234 |

|

|

| |

65 |

£7,247 |

£6,808 |

|

|

| |

70 |

£8,170 |

£7,616 |

|

|

£100,000 purchase, level rates, standard

Unisex rates and joint life basis |

|

|

|

|

|

| |

Plan your annuity and get quotes from the 12 leading providers |

|

| |

| |

|

Free Annuity Quotes |

| |

|

No Obligation |

| |

|

From All Providers |

|

|

|

|

|

|

|

|

|

| You can follow the latest annuity updates on Twitter or as a fan on Facebook |

|

| |

|

|

|

|

|