Standard annuities up to 15.6% higher

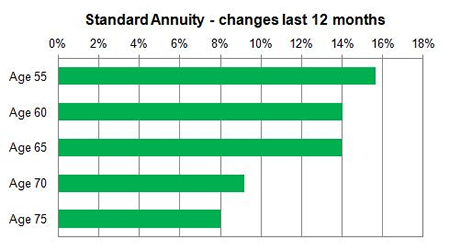

Annuities can have a range of features added such as joint life, guaranteed periods and escalation. The average increase in the standard rates last year was 10.1% and varied considerably with younger people benefiting the most with the biggest gains. The following chart shows ages from 55 to 75 with a £100,000 fund, no guaranteed period and single life basis.

|

| Fig 1: Change in standard annuity rates last year to Jan 2014 |

For standard annuities the largest gain was for those aged 55 with with rates up by 15.6%. The highest increases applied for level rates and those with guaranteed periods and the rates for joint life were loser at between 12% to 14%. For those selecting escalation the gains were less with the highest at 9.2% and the lowest 3.9% for a 50% joint life annuity with 3% escalation.

Enhanced annuities up to 22.6% higher

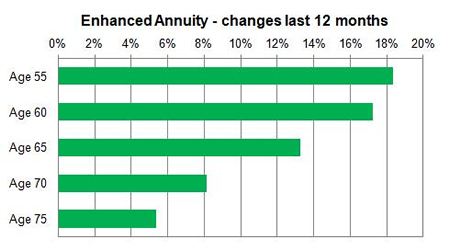

The average for the smoker and enhanced rates was better than standard annuities at 12.1%. The following chart shows enhanced rates for ages from 55 to 75 with a £100,000 fund, no guaranteed period and single life basis.

|

| Fig 2: Change in enhanced annuity rates last year to Jan 2014 |

For smoker and enhanced annuities the gains were higher with the maximum for those aged 55 selecting a 3% escalating rate on a single life basis where the was 22.6%. Again younger people benefited for the level rates with gains of 13% to 18% for those aged 55 to 65. The lowest gains were for people aged 75 on a single life basis with 3% escalation with gains of 6.1%.

People retiring with 30.6% more income

For those that remained invested during the year in a fund that tracked the FTSE-100 index would have benefited from a combined improvement in equities and annuity rates.

The FTSE-100 index increased 852 points or 14.4% from 5,897 to 6,749. As an example, a person aged 65 with a fund of £100,000 in December 2012 could have received an annuity of £5,425 pa on a single life and level basis. One year later their fund would have increased to £114,440 and the annuity rates increased by 14.2% which means the income would have improved by £1,665 pa to £7,090 pa.

In terms of lifetime income, the Office of National Statistics (ONS) would expect a male to live for 17.3 years and he will have £28,804 more over his lifetime. For a female she can expected to live for 20.4 years increasing her income by £33,966.

|