|

2 October 2017 last updated |

|

| Enhanced annuity rates up as central banks signal interest rate rise |

|

Enhanced annuities are up 1.75% following 15-year gilt yields increased 26 basis points after the Bank of England and US Federal Reserve signal a rise in

interest rates this autumn.

Annuity rates have been strong during the summer outperforming 15-year gilt yield levels which have now increased 26 basis points to 1.67%.

As a general rule the rise in yields would result in higher rates, however, standard annuity providers have maintained rates although enhanced annuity rates are higher by 1.75%.

The Governor of the Bank of England had signaled a rise in interest rates could occur as early as November 2017 which would be the first rise in a decade despite the monetary policy committee voted 7-2 in favour of holding interest rates at 0.25%.

Janet Yellen of the US Federal Reserve has also signaled a rate rise and said the Fed should be wary of moving too gradually due to risks the labor market could overheat, resulting in inflation and prices rising too rapidly.

|

|

|

| |

A possible rise in interest rates this autumn sends gilt yields to 1.67% and enhanced annuities higher |

|

|

|

| |

|

Annuity rates remain strong

The 15-year gilt yields have increased 26 basis points from 1.41% to 1.67% Countering the fall in gilts in August and giving support to the current high levels of annuity rates.

|

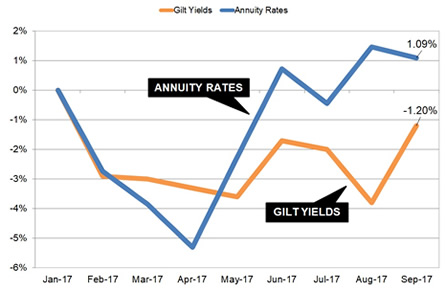

| Fig 1: Chart comparing standard annuity rates and 15-year gilt yields |

The above table shows standard annuity rates for our benchmark example of a 65 year old buying a single life, level annuity with a fund of £100,000. Rates are now 1.09% higher than they were in January whereas gilt yields remain -1.20% below but this gap is closing.

Since the beginning of the year both annuities and gilt yields reduced by the end of April due to geopolitical uncertainty in Europe, wage data in the US pointing to lower inflation and worries over President Trump's economic policies. Our benchmark example reached a low with an income for a £100,000 fund of £5,108 pa.

Annuity rates bounced back strongly as the ECB suggested the €1.1 trillion quantitative easing (QE) programme would be stopped by the end of the year with investors selling gilts and bonds sending the price down and yields higher.

By August our benchmark example reached a high with an income for a £100,000 fund of £5,473 pa, despite a fall in yields now -3.8% below the January level.

The expectation is for interest rates in the US and UK to rise and the ECB to stop quantitative easing by the end of the year.

Federal Reserve $4.5 trillion portfolio

In addition the

Federal Reserve has announced it will begin the unwinding of its massive $4.5 trillion portfolio following the financial crisis and their bond buying QE programme.

This will begin sometime this year and the plan is to slowly allow maturing bonds to roll off its balance sheet at a rate of $6 billion government bonds and $4 billion mortgage-backed securities each month.

Once the Fed stays on the sidelines, demand for bonds will weaken lowering prices and forcing interest rates to climb. This will have a long term impact to raise yields on bonds and gilts although the Fed will act to minimise any short term volatility for equity markets.

|

| |

|

|

|

|

|

|

|

| |

Age |

Single |

Joint |

|

|

| |

55 |

£6,132 |

£5,784 |

|

|

| |

60 |

£6,532 |

£6,234 |

|

|

| |

65 |

£7,247 |

£6,808 |

|

|

| |

70 |

£8,170 |

£7,616 |

|

|

£100,000 purchase, level rates, standard

Unisex rates and joint life basis |

|

|

|

|

|

| |

Plan your annuity and get quotes from the 12 leading providers |

|

| |

| |

|

Free Annuity Quotes |

| |

|

No Obligation |

| |

|

From All Providers |

|

|

|

|

|

|

|

|

|

| You can follow the latest annuity updates on Twitter or as a fan on Facebook |

|

| |

|

|

|

|

|