|

17 August 2023 last updated |

|

| Gilt yields soar to record 5pc as providers resist higher annuity rates |

|

| |

Gilt yields soar 48 basis points to 5.01% although providers have yet to improve annuity rates. |

|

|

|

|

|

Gilt yields soar to a record 5.01% as investors expect higher interest rates for longer from central banks while providers resist increasing annuity rates.

Providers resist increasing annuity rates despite 15-year gilt yields rising +48 basis points in August and closing at a record level for the year of 5.01%. This is the first time yields are over 5% since the mini budget in September 2022.

As rates are mainly based on gilt yields movements we would expect a rise of 4.8% but several providers such as Canada Life and Legal & General have not changed annuity rates.

Other providers like Just Retirement have improved their rates each day whereas Scottish Widows has increased and decreased their rates and Aviva reduced many of their rates.

Find related news here:

Pension annuities fall after lower than expected inflation hits gilt yields

Annuity rates at risk as inflation falls with gilt yields 52 basis points lower

Central banks in the US and UK have noted the better than expected economic growth and low unemployment as reasons interest rates can remain higher for longer with further increases expected this year.

In the US inflation has remained lower with the consumer price index reducing from 4% in June to 3.2% in August. In the UK inflation is also lower falling from 8.7% in June to 6.8% in August.

The Bank of England is likely to raise interest rates at their next meeting in September by 0.25% due to the higher than expected rise in wages and higher food inflation.

|

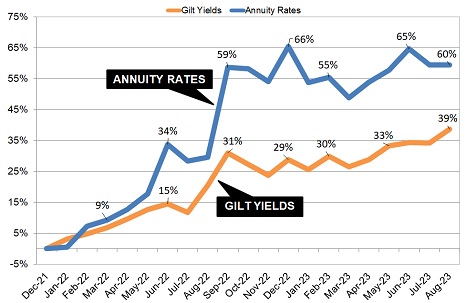

| Fig 1: Chart comparing annuity rates and 15-year gilt yields |

The above chart shows annuities remain at a fourteen year high for our our benchmark example for a 60 year old using £100,000 to purchase a single life and 3% escalating income.

Providers have decreased annuity rates for the benchmark being up 65% in June 2023 when compared to December 2021 and is now lower at 60% higher in August.

In contrast

15-year gilt yields had increased 24% in November 2022 when compared to December 2021 and has increased consistently to 39% up by August.

For a percentage increase, the biggest is for those aged 55 years old with a fund of £100,000 based on 50% joint life annuity with 3% escalation and income up +87% or £1,726 pa since December 2021.

The largest monetary gain with a fund of £100,000 is for those aged 74 years based on single life and level income with percentage rise of +38% and monetary amount of £2,631 pa.

Providers increased annuities in June and July and may be waiting to see if gilt yields remain at this higher level or fall back before making any improvements in rates.

This is due to additional central bank base rates already being priced-in to gilt yields up to July and providers are struggling with delays due to high volumes of applications.

Assuming gilt yields do not fall back to previous levels, annuity rates may increase by up to +4.8% in the medium term.

|

|

|

|

|

|

|

| |

Age |

Single |

Joint |

|

|

| |

55 |

£6,132 |

£5,784 |

|

|

| |

60 |

£6,532 |

£6,234 |

|

|

| |

65 |

£7,247 |

£6,808 |

|

|

| |

70 |

£8,170 |

£7,616 |

|

|

£100,000 purchase, level rates, standard

Unisex rates and joint life basis |

|

|

|

|

|

| |

Plan your annuity and get quotes from the 12 leading providers |

|

| |

| |

|

Free Annuity Quotes |

| |

|

No Obligation |

| |

|

From All Providers |

|

|

|

|

|

|

|

|

|

| You can follow the latest annuity updates on Twitter or as a fan on Facebook |

|

| |

|

|

|

|

|