|

27 November 2021 last updated |

|

| Pension annuities could fall over 1pc with new Covid variant Omicron |

|

| |

Pension annuities could rise fall by 1.3% with lower gilt yields due to the new Omicron variant |

|

|

|

|

|

Pension annuities are at risk of falling 1.3% as gilt yields reduce 13 basis points due to uncertainty of the economic impact of the new Covid variant Omicron.

The new Covid variant Omicron named by the World Health Organisation and initially called B.1.1.529 was detected in South Africa and is spreading quickly with investors seeking the safety of bonds and gilts.

Pension annuities are based predominately on the 15-year gilt yields which decreased 13 basis points to 1.0% and providers may decrease rates by up to 1.3% if yields remain at current levels.

Equity markets also reacted with the FTSE-100 index reducing by 3.64% to 7,044 the biggest single day fall for over a year and this means people retiring that remain invested have less money to buy an income.

Providers had increased annuity rates by about 2.5% in October as there was an expectation of central banks increasing base rates due to rising inflation which is now running at over 4% pa.

Find related news here:

Gilt yields fall as investors seek safe havens with spread of Delta variant

Bank of England could raise base rates sending gilt yields higher

The Bank of England were planning to increase base rates as early as December and it is uncertain if the Omicron variant will change their decision and there is speculation this could impact when the Federal Reserve raise rates in 2022.

South Africa, Botswana, Eswatini, Lesotho, Namibia and Zimbabwe have been moved onto the travel red list of many countries. If restrictions are extended more widely it could threaten the economic recovery resulting in Brent crude oil prices reducing by 10.7% from $82.22 to $73.45, the biggest fall since April last year.

|

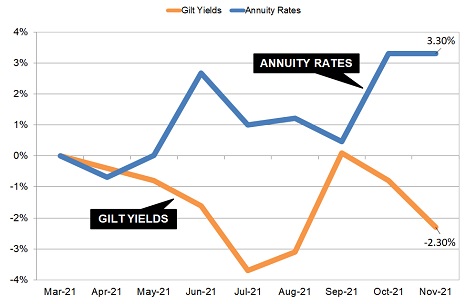

| Fig 1: Chart comparing annuity rates and 15-year gilt yields |

The above chart compares annuity rates for our benchmark of a person aged 65 years old with a fund of £100,000 buying a lifetime annuity on a single life, level basis to the 15-year gilt yields.

Since March 2021 pension annuity rates have remained strong and are 3.3% higher even though gilt yields have reduced and are lower by -2.3% over the same period.

For our benchmark the annuity income reached a low in January 2021 of £4,786 pa and this increased to

£4,999 by March. Annuity income for our benchmark has increased £165 pa to £5,164 pa in the last eight months.

Since the end of lockdown and the recovery of the economy, demand and bottlenecks in the supply chain has seen inflation rise with an expectation that base rates will increase in 2022.

This may be one of the driving force behind providers keeping

annuity rates higher than expected although this is threatened by the appearance of the Omicron variant.

Initial reports from virologists studying the Omicron variant show there are 30 mutations on its spike protein used to unlock the bodies cell and the fear is antibodies and vaccinations may not offer adequate defenses.

Until there is more research conducted and the potential impact of the Omicron variant determined, providers are likely to maintain annuity rates at or near current levels for the next month especially as many are competing for business to meet targets for the end of the the year.

|

|

|

|

|

|

|

| |

Age |

Single |

Joint |

|

|

| |

55 |

£6,132 |

£5,784 |

|

|

| |

60 |

£6,532 |

£6,234 |

|

|

| |

65 |

£7,247 |

£6,808 |

|

|

| |

70 |

£8,170 |

£7,616 |

|

|

£100,000 purchase, level rates, standard

Unisex rates and joint life basis |

|

|

|

|

|

| |

Plan your annuity and get quotes from the 12 leading providers |

|

| |

| |

|

Free Annuity Quotes |

| |

|

No Obligation |

| |

|

From All Providers |

|

|

|

|

|

|

|

|

|

| You can follow the latest annuity updates on Twitter or as a fan on Facebook |

|

| |

|

|

|

|

|