|

| 5 December 2013 last updated |

|

| Retirement annuity income 2.3% lower as equity markets fall |

|

Retirement annuity income for those that remain invested before they buy their annuity has decreased by 2.3% after a fall in equities following market expectation the Federal Reserve will decide action for the US stimulus tapering as equity markets fall.

Although the prospects for a rise in annuity rates is good after the 15-year gilt yields increased 13 basis points this month, equity markets have been falling with the FTSE-100 index 153 points lower with the Dow Jones 365 points lower at 15,821.

The fall in markets is due to investors returning to whether the US Federal reserve will begin to taper the $85 billion per month stimulus package starting possibly as early as December.

The expectation was that tapering would not begin until March 2014, however, better than expected US jobs data

has renewed speculation that the Federal Reserve may plan an earlier start date. This has prompted some to take their gains before the end of the year and started series of consecutive falls in the markets.

|

|

|

| |

Equity markets fall has reduced income by 2.3% for those retiring and buying an annuity |

|

|

|

| |

|

Lower equities reducing annuity income

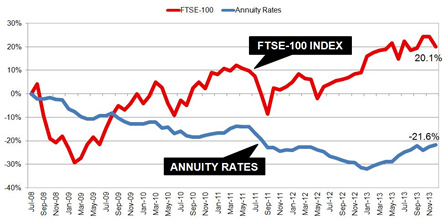

The FTSE-100 index has reduced by 153 points or 2.3% in December and as most people remain invested right up to the time they take their benefits this will directly reduce the income they will receive at retirement. The chart below shows how annuity rates and the FTSE-100 index have changed since July 2008.

|

| Fig 1: Chart comparing annuity rates and FTSE-100 index |

Equities have recovered strongly and are now 20.1% higher than in July 2008 whereas annuity rates remain 21.6% lower. The recent falls in equities mean an immediate reduction that an annuity can offer.

For example, our benchmark is for a person aged 65 with a fund of £100,000 buying a single life, level annuity of £6,196 pa in November and the smaller fund of £97,700 could by an income that is £142 pa lower at £6,054 pa.

In terms of lifetime income, the Office of National Statistics (ONS) would expect a male to live for 17.3 years and he will have £2,456 more over his lifetime. For a female she can expected to live for 20.4 years increasing her income by £2,896.

Gilt yields higher on US taper fears

The 15-year gilt yields are higher by 13 basis points this month and as a general rule with would result in a 1.3% increase in annuity rates. Impaired annuity providers have been reducing their rates as we end the year and adjusting benefits offered to medical conditions resulting in a mixture of higher and lower rates across the board.

The rise is due to the renewed talk by the Federal Reserve to start tapering of the $85 billion per month stimulus package which has provided significant liquidity to the equity and bond markets. Both these markets have seen price falls as investors sell and for bonds and gilts this increases the yields.

The stimulus package buys bonds allowing investors to purchase higher yielding securities and much of this has found it's way to Asia resulting in an inflated market. With the prospect of lower levels of stimulus investors in Asia have been taking their profits and the concern for the Federal Reserve is panic with rapidly falling equity and bond markets creating instability and raising the cost of government and mortgage debt.

For people retiring now annuity rates are likely to rise if the US Federal Reserve announce a plan to taper the stimulus package earlier and more aggressively than expected. If they delay this process markets will return to buying equities and bonds an annuity rates will decrease slightly from current levels.

|

|

|

|

|

|

|

|

| |

Age |

Single |

Joint |

|

|

| |

55 |

£6,132 |

£5,784 |

|

|

| |

60 |

£6,532 |

£6,234 |

|

|

| |

65 |

£7,247 |

£6,808 |

|

|

| |

70 |

£8,170 |

£7,616 |

|

|

£100,000 purchase, level rates, standard

Unisex rates and joint life basis |

|

|

|

|

|

| |

Plan your annuity and get quotes from the 12 leading providers |

|

| |

| |

|

Free Annuity Quotes |

| |

|

No Obligation |

| |

|

From All Providers |

|

|

|

|

|

|

|

|

|

| You can follow the latest annuity updates on Twitter or as a fan on Facebook |

|

| |

|

|

|

|

|