|

| 13 April 2014 last updated |

|

| UK annuity income is lower after FTSE-100 index falls on tech bubble fears |

|

Income from UK annuities has reduced for those that remain invested after equity market falls 3.8% with fears of a dotcom bubble and poor earnings of US companies.

Many people remain invested before purchasing their annuities and if their pension tracks the FTSE-100 index they would have seen a 3.8% fall. This will be reflected in the amount of income they will receive from an annuity.

The FTSE-100 index has lost a further £20.2 billion as technology companies report lower earnings suggesting another dotcom bubble with the US Nasdaq stock exchange suffering the greatest fall since November 2011.

The FTSE was at 6,824 at the beginning of March and has since lost 263 points to 6,561 with dotcom stocks like Netflix, Facebook, Twitter and Linkedin some 20% to 45% below recent highs.

Investors are also moving funds to safe havens such as US Treasury notes and UK government bonds and gilts driving down yields.

|

|

|

| |

People that remain invested before buying annuities will have 3.8% less income as equities fall |

|

|

|

| |

|

Gilt yields risk lower annuity rates

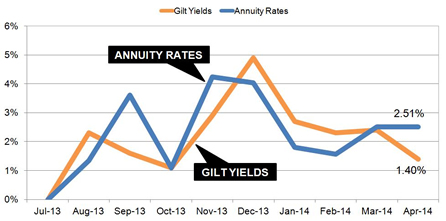

The impact from the Ukraine crisis and technology firm earnings have sent investors looking for safe havens sending yields 11 basis points lower to 3.07%, last reached in October 2013. Annuity rates are primarily based on the 15-year gilt yields and as a general rule a 11 basis point fall would result in a 1.1% fall in rates.

The following chart shows the strong correlation between gilt yields and annuities since July 2013.

|

| Fig 1: Chart comparing annuity rates and 15-year gilt yields |

Greater competition later in 2013 resulted in higher annuity rates which was followed by a slow start to 2014 and rates lower than expected when compared to gilt yields. There is a risk that annuities will decrease by 1.1% if yields do not improve although since the Budget introducing radical changes providers may feel their market is at risk of shrinkage and maintain rates in the short term.

Income from annuities £4,000 lower over a lifetime

For people that remain invested before deciding to buy an annuity the income they can expect will be lower over the last month. Our benchmark example for a person aged 65 with a fund of £100,000 could have purchased a single life, level annuity with an income of £6,093 pa. Since markets have reduced the fund would be lower at £96,200 and the income is only £5,861 pa today, a reduction of £232 pa or 3.8%.

In terms of lifetime income, the Office of National Statistics (ONS) would expect a male to live for 17.3 years and he will have £4,013 less over his lifetime. For a female she can expected to live for 20.4 years decreasing her income by £4,732.

|

|

|

|

|

|

|

|

| |

Age |

Single |

Joint |

|

|

| |

55 |

£6,132 |

£5,784 |

|

|

| |

60 |

£6,532 |

£6,234 |

|

|

| |

65 |

£7,247 |

£6,808 |

|

|

| |

70 |

£8,170 |

£7,616 |

|

|

£100,000 purchase, level rates, standard

Unisex rates and joint life basis |

|

|

|

|

|

| |

Plan your annuity and get quotes from the 12 leading providers |

|

| |

| |

|

Free Annuity Quotes |

| |

|

No Obligation |

| |

|

From All Providers |

|

|

|

|

|

|

|

|

|

| You can follow the latest annuity updates on Twitter or as a fan on Facebook |

|

| |

|

|

|

|

|