|

5 February 2018 last updated |

|

| Annuities rise up to 5% with higher yields from US economic growth |

|

Annuity rates from providers are up to 5% higher after a 25 basis point rise in gilt yields as the US ecomony reports growth with strong economic data and expectation of higher interest rates.

Providers have increased standard rates by up to 5.7% for certain ages and features of annuities during the month as gilt yields rise 25 basis points during January.

Annuity rates are

primarily based on the 15-year gilt yields and an 25 basis point rise this month would mean we can expect a 2.5% increase in rates.

Strong gross domestic product data showed GDP growth for the US economy up 2.6% for the fourth quarter 2017.

The figures indicate economic growth continues and the likelyhood of the US Federal Reserve to raise interest rates in March to help contain a boyant market currently with high valuations.

US equity markets have reacted to future higher interest rates and the Dow Jones index is down 4.6% or 1,175 points at 24,345.

|

|

|

| |

Strong performance data from US economy drives yields higher and annuity rates rise up to 5% |

|

|

|

| |

|

Annuity rates at two year high

Standard annuity rates have reached a two year high for our benchmark example (see table and chart below) is for a 65 year old buying a single life, level annuity with a fund of £100,000.

This has increased since the all time low reached in August 2016 of £4,696 pa rising 18.1% or £850 pa to to the current level of £5,546 pa. The highest previous level was £5,633 pa in February 2016 before the EU Referendum which send thesterling and gilt yields significantly lower.

| |

Standard annuity rates and gilt yields |

|

| |

Jul |

Aug |

Sep |

Oct |

Nov |

Dec |

Jan |

| Rate |

£5,370 |

£5,473 |

£5,473 |

£5,390 |

£5,503 |

£5,476 |

£5,546 |

| Yield |

1.59% |

1.41% |

1.34% |

1.66% |

1.63% |

1.50% |

1.75% |

|

The table above shows how gilt yields have improved from 1.34% in September 2017 to 1.75% in January 2018.

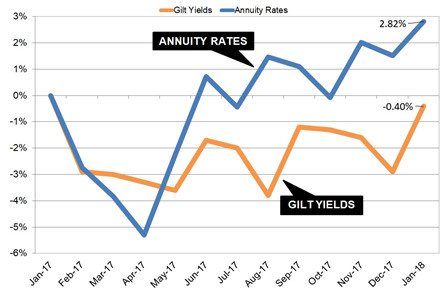

The chart below shows that providers have maintained annuities at a higher level than 15-year gilt yield siince May last year although there is some resistance to increase rates rapidly at the moment allowing the chart to converge over the medium term.

In the shorter term of six months since July 2017 annuity rates are higher by 3.2% compared to yields up by 16 basis points (so we would expect annuities to be up about 1.6%) and providers have been more boyant with their rates.

|

| Fig 1: Chart comparing standard annuity rates and 15-year gilt yields |

For our benchmark example income has increased by £850 pa since August 2016. In terms of lifetime income, the Office of National Statistics (ONS) would expect a male to live for 17.3 years and he will have £14,705 less over his lifetime. For a female she can expected to live for 20.4 years decreasing her lifetime income by £17,340.

The Chair of the Federal Reserve changes on 3 February from Janet Yellen to Jerome Powell and funding for the government is only possible to the end of February unless the debt ceiling is approved by congress.

Interest rates remain depressed around the world due to quantitative easing and both the Bank (BOJ) of Japan and European Central Bank (ECB) have indicated they will maintain their stimulus for the foreseable future.

For those planning to take their benefits as an annuity there is momentum in the expectation of higher interest rates driving yields and annuity rates higher in the first quarter of 2018.

|

| |

|

|

|

|

|

|

|

| |

Age |

Single |

Joint |

|

|

| |

55 |

£6,654 |

£6,281 |

|

|

| |

60 |

£7,014 |

£6,666 |

|

|

| |

65 |

£7,652 |

£7,219 |

|

|

| |

70 |

£8,619 |

£7,918 |

|

|

£100,000 purchase, level rates, standard

Unisex rates and joint life basis |

|

|

|

|

|

| |

Plan your annuity and get quotes from the 12 leading providers |

|

| |

| |

|

Free Annuity Quotes |

| |

|

No Obligation |

| |

|

From All Providers |

|

|

|

|

|

|

|

|

|

| You can follow the latest annuity updates on Twitter or as a fan on Facebook |

|

| |

|

|

|

|

|