|

24 December 2020 last updated |

|

| Retirement income bounces back with strong stock market rise |

|

| |

Income from invested pensions has increased 16.5% with news of successful vaccine trials. |

|

|

|

|

|

Income from pensions that remain invested at retirement has bounced back up 16.5% since October helped by successful vaccines which could end economic uncertainty.

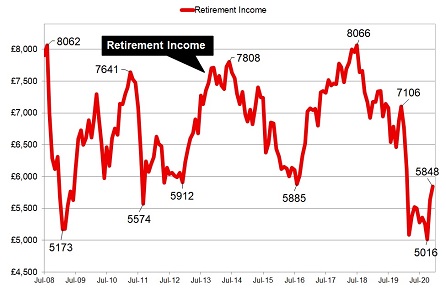

Income for our benchmark example reached an all time low in October of £5,016 per year down -37.8% from the high of £8,066 per year reached in July 2018.

The retirement income has now increased 16.5% from £5,016 to £5,848 per year. This income is based on the annuity rate for a 65 year old in good health buying a single life, monthly advanced payment and level income and the rise in the FTSE-100 index.

Find related news here:

Equity markets rise 14% as vaccines could end economic uncertainty

Retirement income at decade low with panic selling on equity markets

The figures for the chart start in July 2008 with a pension fund of £100,000 invested in a portfolio tracking the FTSE-100 index and shows how the buying power of the fund changes with the rise and fall of the fund value and annuity rates.

|

| |

Benchmark annuity rates and FTSE-100 index |

|

| |

Jun |

Jul |

Aug |

Sep |

Oct |

Nov |

Dec |

| FTSE |

6,169 |

5,897 |

5,963 |

5,866 |

5,577 |

6,266 |

6,502 |

| Rate |

£4,825 |

£4,843 |

£4.863 |

£4,848 |

£4,867 |

£4,867 |

£4,867 |

|

Fig 1: Chart and table comparing retirement income from 2008 to 2020 |

Annuity rates have remained very consistent over the last six months as the 15-year gilt yields has remained at record low levels since the Coronavirus lockdown in March 2020.

Our benchmark example

for £100,000 with a 65 year old buying a single life and level basis the annuity income is currently £4,867 per year.

In July 2008 the annuity on the same basis was £7,908 per year and although annuity rates have reduced constantly since this date, rising equity markets were able to return the buying power back up to £8,066 per year in July 2018 a decade later.

Of course this does not take account of inflation over that period that would increase the cost of living. This shows the increasing difficulty of generating income at retirement.

Annuities have remained low and consistent throughout the year even when the 15-year gilt yields reduced to all time lows and are currently at 0.49%.

Global equity markets have been rising with the Dow Jones reached an all time high 30,303 on 17 December 2020. There is an expectation the US congress can agree a fiscal stimulus plan which had reduced to $748 billion. The funds will provide support for small business and benefits to citizens struggling with the Covid-19 cases.

European stocks have been rising with the German DAX at 13,587 near to the high reached in February before markets fell as the Coronavirus pandemic spread in Europe and lockdown. Markets are optimistic for a Brexit trade deal and the possibility the Covid-19 vaccine will available before the end of the year.

Meanwhile the FTSE-100 index remains -14.6% below the February high of 7,674 as investors are cautious about the impact of Brexit on the UK together with the Coronavirus disruption to the economy.

Annuity rates are likely to remain low due to quantitative easing from central banks, low bank interest rates and gilt yields at all time low levels. UK equities could realise gains helping pension funds and flexi-access drawdown plans to recover during 2021 with vaccines allowing the economy to normalise and businesses adapting to the UK our or Europe with or without a deal.

|

|

|

|

|

|

|

| |

Age |

Single |

Joint |

|

|

| |

55 |

£6,654 |

£6,281 |

|

|

| |

60 |

£7,014 |

£6,666 |

|

|

| |

65 |

£7,652 |

£7,219 |

|

|

| |

70 |

£8,619 |

£7,918 |

|

|

£100,000 purchase, level rates, standard

Unisex rates and joint life basis |

|

|

|

|

|

| |

Plan your annuity and get quotes from the 12 leading providers |

|

| |

| |

|

Free Annuity Quotes |

| |

|

No Obligation |

| |

|

From All Providers |

|

|

|

|

|

|

|

|

|

| You can follow the latest annuity updates on Twitter or as a fan on Facebook |

|

| |

|

|

|

|

|