|

3 July 2022 last updated |

|

| Annuity rates rise by record 7pc last month as gilt yields weaken |

|

| |

Standard annuities rise at record 7% for June but gilt yields fall due to recession fears

|

|

|

|

|

|

Annuity rates have increased by a record 7.05% for a single month in June at a time gilt yields weaken as investors fear recession.

Providers increase standard annuity rates by 7.05% and enhanced annuities by 8.79% in June, the highest amounts on record for a single month.

Annuities are based mainly on the

15-year gilt yields which increased 19 basis points to end the month at 2.59%. During the month yields reached an eight year high of 2.92% before a 33 basis point fall due investor concern of recession.

Evidence of a slowdown in global growth has spooked the markets for energy, metals and agriculture with prices falling up to -34%. This alone has reduced the US two-year inflation projections by 1.1% and is now only 3.6%. In particular aluminum and platinum and lower by -13%, wheat and cotton lower by -16%, copper down -18% and US gas down -34%.

Find related news here:

Gilt yields fall 33 basis points off peak due to investor recession fears

Ban on Russian oil sends gilt yields to 2.4pc and higher annuity rates

Central banks are rapidly increasing base rates to control inflation increasing the cost to business to make investments and homeowner mortgages which can accelerate the path to recession. The Federal Reserve is particularly hawkish with plans to raise base rates well into 2023.

If recession continues to develop, falling energy and commodity prices could suggest changes to the approach of central banks with investors seeking the security of safe havens such as Treasury notes, gilts and bunds. This would have implications for annuity rates that have increased faster than yields this year.

|

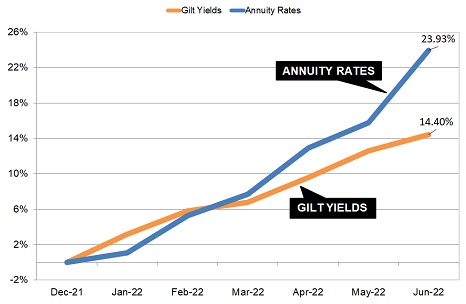

| Fig 1: Chart comparing annuity rates and 15-year gilt yields |

The above chart shows the average change in annuity rates since December 2021 to date based on a person aged 65 years old with a fund of £100,000 buying a lifetime annuity on a single life, level basis and compares this to the 15-year gilt yields.

Providers have been very aggressive this year increasing annuity rates by 23.93% compared to gilt yields up 14.40%. This suggests providers have priced-in a rise in gilts of 95 basis points to 3.54%.

If the gilt yields rise cannot reach 3.54% it is likely providers will start to reduce annuity rates and this is the risk developing for people ready to buy a lifetime annuity at retirement.

Annuities with some features have

increased significantly this year such as those aged 55 buying a 50% joint life with 3% escalation rising 42.3% or single life with 3% escalation rising 36.0% and a single life level basis up 29.8%.

For those aged 60 buying a single life

with 3% escalation annuity rates are higher by 33.7% and 50% joint life with 3% escalation rising 34.5%.

For example, someone aged 55 with £100,000 could purchase a single life, level annuity in December 2021 with income of £3,870 pa and this has increased by £1,155 pa to £5,025 pa.

In terms of total income during their life for an annuitant aged 55, the Office of National Statistics (ONS) would expect a male to live for 27.1 years and he will have £31,300 more over his lifetime by taking an annuity now compared to a December 2021. For a female she can expected to live for 29.9 years increasing her lifetime income by £34,534.

With the first signs of global recession with inflation projections falling, the rapid rise in 15-year gilt yields weakening leaves annuity rates exposed having increased at a faster pace than yields.

|

|

|

|

|

|

|

| |

Age |

Single |

Joint |

|

|

| |

55 |

£6,654 |

£6,281 |

|

|

| |

60 |

£7,014 |

£6,666 |

|

|

| |

65 |

£7,652 |

£7,219 |

|

|

| |

70 |

£8,619 |

£7,918 |

|

|

£100,000 purchase, level rates, standard

Unisex rates and joint life basis |

|

|

|

|

|

| |

Plan your annuity and get quotes from the 12 leading providers |

|

| |

| |

|

Free Annuity Quotes |

| |

|

No Obligation |

| |

|

From All Providers |

|

|

|

|

|

|

|

|

|

| You can follow the latest annuity updates on Twitter or as a fan on Facebook |

|

| |

|

|

|

|

|