|

28 September 2022 last updated |

|

| Annuities rise 12pc to thirteen year high after Mini Budget fallout |

|

| |

Annuities rise over 12% this month as gilt yields increase due to aggressive central banks.

|

|

|

|

|

|

Annuities increase over 12% this month after gilt yields rise 168 basis points to 4.87% due to central banks raising base rates to counter inflation and the Mini Budget.

The 15-year gilt yields have increased 168 basis points to 4.87% in September with annuity rates rising by 12.0% from providers and now at a thirteen year high.

For our benchmark example of a 65 year old with £100,000 purchasing a single life and level annuity the income is £7,096 pa, the first time at this level since August 2009.

Central banks have aggressively raised base rates to counter inflation with the Federal Reserve up 0.75% to 3.08%, the ECB raising rates by 0.75% to 1.25% and the Bank of England raising rates 0.5% to 2.25%.

In addition the Mini Budget on Friday where the UK would be funding tax cuts through extra borrowing had a negative reception from the markets. The pound reduced further against the dollar to 1.08 and there has been a sudden rise in yields as investors sell gilts.

Find related news here:

Gilt yields up 87 basis points as investors expect base rates to rise

Annuity rates rise by record 7pc last month as gilt yields weaken

Annuities are based mainly on the 15-year gilt yields which has increased 295 basis points from 1.14% at the end of last year to 4.87%.

|

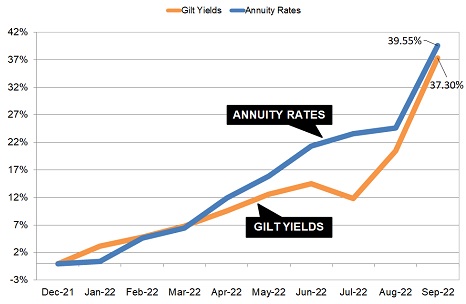

| Fig 1: Chart comparing annuity rates and 15-year gilt yields |

The above chart shows our benchmark example of a 65 year old in good health buying a lifetime annuity with £100,000 on a single life and level basis the income has increased 39.55% or £2,011 pa already this year from £5,085 pa in December 2021 to £7,096 pa today.

With the strong rise of 168 basis points for 15-year gilt yields this month and 37.3% rise for the year, the gap between the rise in annuity rates and yields has closed. Annuities are 2.25% ahead of yields and providers may edge rates higher if they expect yields to continue upwards, which is likely.

In terms of total income during their life for an annuitant aged 65, the Office of National Statistics (ONS) would expect a male to live for 18.8 years and he will have £37,806 more over his lifetime by taking an annuity now compared to a December 2021. For a female she can expected to live for 21.2 years increasing her lifetime income by £42,633.

Central banks have re-affirmed their intension to raise base rates for the rest of 2022 to drive down inflation. Core CPI inflation in the US increased unexpectedly from 6.0% to 6.3% in September and in the UK CPI reduced slightly from 10.1% to 9.9%.

Therefore it is likely base rates will continue to rise this year sending gilt yields and annuity rates

higher until central banks stop raising rates.

|

|

|

|

|

|

|

| |

Age |

Single |

Joint |

|

|

| |

55 |

£6,654 |

£6,281 |

|

|

| |

60 |

£7,014 |

£6,666 |

|

|

| |

65 |

£7,652 |

£7,219 |

|

|

| |

70 |

£8,619 |

£7,918 |

|

|

£100,000 purchase, level rates, standard

Unisex rates and joint life basis |

|

|

|

|

|

| |

Plan your annuity and get quotes from the 12 leading providers |

|

| |

| |

|

Free Annuity Quotes |

| |

|

No Obligation |

| |

|

From All Providers |

|

|

|

|

|

|

|

|

|

| You can follow the latest annuity updates on Twitter or as a fan on Facebook |

|

| |

|

|

|

|

|