|

| 11 January 2014 last updated |

|

| Best annuities threat as gilt yields fall after poor US jobs data |

|

Annuity rates are under threat as the 15-year gilt yields fall 13 basis points following worse than expected US jobs data suggesting a sluggish start to the year when compared to a year ago.

Gilt yields reached a high of 3.47% in December after the Federal Reserve announced they were reducing the US stimulus package by $10 billion a month to $75 billion.

A reduction in stimulus means less support for the inflated bonds market and investors moved their funds away from secure bonds and gilts reducing the price and increasing the yield.

Even though yields were higher the best annuities remained unchanged during this period and have not changed in the new year even though yields remained higher than last year.

As annuities are mainly based on the 15-year gilt yields a change of 10 basis points would usually be followed by a 1.0% change in rates at some point.

|

|

|

| |

US jobs data lower than expected reducing gilt yields as investors seek safe havens |

|

|

|

| |

|

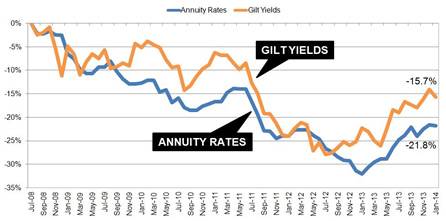

Annuity to gilt yields gap remains significant

The 15- year gilt yields have reduced from 4.83% to 3.26% or a 157 basis points. We would have expected annuities to have reduced by 15.7% and today they have reduced further to 21.8%. Some of this difference would have been due to the EU Gender Directive where male rates were reduced and female rates increased with an overall effect of lower pension annuities.

The chart below shows how annuity rates and the gilt yields have changed since July 2008.

|

| Fig 1: Chart comparing annuity rates and 15-year gilt yields |

Since the financial crisis began annuity rates have reduced. Our benchmark example for a person aged 65 with a fund of £100,000 could have purchased a single life, level annuity with an income of £7,908 pa in July 2008. The same fund would purchase an income of only £6,184 pa today, a reduction of £1,724 pa or 21.8%.

In terms of lifetime income, the Office of National Statistics (ONS) would expect a male to live for 17.3 years and he will have £29,997 less over his lifetime. For a female she can expected to live for 20.4 years decreasing her income by £35,169.

US jobs data likely to bounce back

The market was concerned with the jobs figures in December where only 74,000 jobs were added compared to the expected amount of 197,000 from analysts. As a result investors moved funds to safe havens such as US Treasury notes and UK government bonds increasing the price and reducing the yields.

Unemployment has fallen from 7.0% to 6.7% although this was mainly due to a lower number of Americans looking for work and being taken off the number available to work. In addition the lower number of jobs created was impacted by colder than expected weather disrupting companies normal employment programmes.

The expectation is that December will be an exception and will not indicate a downward trend as the previous four months averaged 214,000. In addition data from other parts of the US economy indicate an improving trend which may see the Federal Reserve continue to taper the stimulus. This would return confidence to investors and a bounce back for bonds and gilt yields could occur later in the first quarter which would increase annuity rates.

|

|

|

|

|

|

|

|

| |

Age |

Single |

Joint |

|

|

| |

55 |

£6,654 |

£6,281 |

|

|

| |

60 |

£7,014 |

£6,666 |

|

|

| |

65 |

£7,652 |

£7,219 |

|

|

| |

70 |

£8,619 |

£7,918 |

|

|

£100,000 purchase, level rates, standard

Unisex rates and joint life basis |

|

|

|

|

|

| |

Plan your annuity and get quotes from the 12 leading providers |

|

| |

| |

|

Free Annuity Quotes |

| |

|

No Obligation |

| |

|

From All Providers |

|

|

|

|

|

|

|

|

|

| You can follow the latest annuity updates on Twitter or as a fan on Facebook |

|

| |

|

|

|

|

|