|

| 16 July 2013 last updated |

|

| Best annuity rates up 2% from leading providers with more competition |

|

The leading providers have increased their best annuity rates by up to 2.0% as competition increases after lagging behind gilt yields this year and still some room for some rates in the future.

The leading providers Legal & General, Canada Life and Aviva have raised their annuity rates to exceeding the gap between standard rates and gilt yields that existed at the end of July.

Annuities are primarily based on the

15-year gilt yields and a 10 basis point change in yields would be followed by a 1.0% change in pension annuities.

By the end of last month there was a difference that suggested rates could increase by 1.87% and they have exceed this expectation. During the first half of the year standard rates were behind and now with yields falling they are ahead in the short term.

Over three months is more room for rates to rise so providers may feel they do not need to follow yields

in the short term unless there are significant falls in yields.

|

|

|

| |

Providers of standard annuities have increased rates by over 2% after lagging behind yields |

|

|

|

| |

|

Our benchmark annuity rate is 2.4% higher

Legal & General were the first to increase their rates by 2.0% increasing our benchmark annuity rate for a 65 year old single life and level basis with a fund of £100,000 from £5,815 pa to £5,934 pa.

Now as competition heats up this has been improved with Aviva offering £5,956 pa, an increase of

£141 pa or 2.4% this month. Over a persons lifetime the Office of National Statistics (ONS) would expect a male to live for 17.3 years and he will receive an extra £2,439. For a female she can expected to live for 20.4 years increasing their income by £2,876 this month alone.

There has been a significant revival from providers in both standard and impaired annuity rates since the beginning of the year. Our benchmark example has increased from £5,373 pa to £5,956 pa, an increase of £583 pa or 10.8%. Males during their lifetime

can expect an extra £10,085 and females £11,893 without taking into account growth in a pension fund for those that remain invested before taking their benefits.

Higher standard rates if gilt yields stabilise

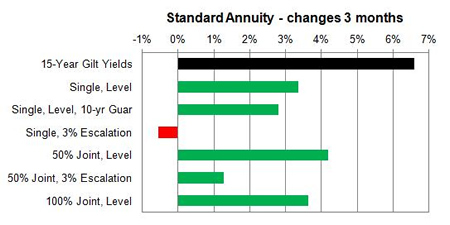

Over a three month period of time the 15-year gilt yields are up 66 basis points whereas standard annuity rates have increased only 4.18% at best or even down by 0.56% for a single life with 3% escalation as shown below.

|

| Fig 1: Change to standard annuities compared to gilt yields |

This means providers have more scope to make increases in the short term even if gilt yields fall slightly as the following chart shows.

|

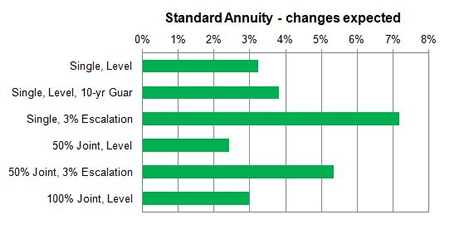

| Fig 2: Changes expected to standard annuities in medium term |

The biggest improvement can come from single life with 3% escalation with up to a 7.16% increase possible or at least a 2.42% improvement for 50% joint life on a level basis. Providers will be under greater pressure if gilt yields continue to fall as they have reduced from 2.99% to 2.85% eroding the above figures by 1.4%.

For people retiring now is a good opportunity to to benefit from higher annuity rates and equities for those that remain invested before buying their annuities.

|

|

|

|

|

|

|

|

| |

Age |

Single |

Joint |

|

|

| |

55 |

£6,654 |

£6,281 |

|

|

| |

60 |

£7,014 |

£6,666 |

|

|

| |

65 |

£7,652 |

£7,219 |

|

|

| |

70 |

£8,619 |

£7,918 |

|

|

£100,000 purchase, level rates, standard

Unisex rates and joint life basis |

|

|

|

|

|

| |

Plan your annuity and get quotes from the 12 leading providers |

|

| |

| |

|

Free Annuity Quotes |

| |

|

No Obligation |

| |

|

From All Providers |

|

|

|

|

|

|

|

|

|

| You can follow the latest annuity updates on Twitter or as a fan on Facebook |

|

| |

|

|

|

|

|