|

27 February 2023 last updated |

|

| Pension annuities could rise 4pc as Fed more hawkish with higher inflation |

|

| |

Pension annuities could rise 4% in the medium term as 15-year gilt yields increase to 4.09%. |

|

|

|

|

|

Pension annuities could rise 4% in the medium term as US inflation increases to 5.4% and the Federal Reserve must consider higher interest rates.

A combination of improved economic data from the US with the consumer price index (CPI) increasing from 5.3% to 5.4% shows inflation is not yet under control.

The more important inflation figure of core CPI was expected to fall and instead increased from 4.6% to 4.7%. Consumer spending was higher on January rising 1.8% with improvements in car and home sales.

Investors expect the Federal Reserve to be more hawkish about increasing interest rates to counter higher inflation with projections for a 0.25% or 0.5% rise for interest rates at the next meeting.

As a result the 15-year gilt yields increased 39 basis points this month from 3.70% to 4.09% and pension annuities could rise 4% in the medium term.

Find related news here:

Yields reduce 32 basis points with investor concerns of global growth

Enhanced annuity rates up 5pc as gilt yields rise 50 basis points

Despite gilt yields increasing strongly in February the providers have not improved annuity rates significantly. This could be due to delays in processing existing applications and reluctance to raise annuity rates to increase work loads for understaffed departments.

|

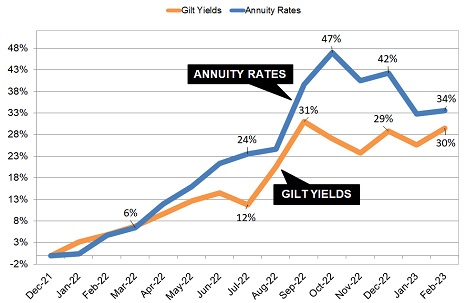

| Fig 1: Chart comparing annuity rates and 15-year gilt yields |

The above chart is based on our benchmark example for a 65 year old using £100,000 to purchase a single life and level annuity. It shows that annuity rates and 15-year gilt yields remain at a twelve year high since October 2022 although annuities have reduced from recent peaks.

Annuity rates are now more closely aligned with gilt yields after being briefly higher during the mini budget. Providers

are in no hurry to raise rates and it may take further increases in yields or greater competition between providers to seen annuity rates increase 4% or more.

The biggest percentage rise since December 2021 is for those aged 55 years old with a fund of £100,000, annuity on a 50% joint life and 3% escalation with pension income rising +68% or £1,349 pa.

In terms of the largest monetary gain with a fund of £100,000, this is for a 75 year old, annuity on a single life and level basis with pension income up £2,355 pa or +34%.

Looking at the next central bank meeting of the Federal Reserve on 21 March 2023, market analysts give the odds of a 0.5% rise in interest rates at 27%. There is now a greater chance of rates rising to 5.5% to 5.75% by July 2023.

The Bank of England is likely to follow with further rise in base rates from the current 4% as inflation remains high at 10.1% in January 2023 with a small decrease fro 10.5% the previous month.

If gilt yields remain at current levels of 4.09% or increase further we may see greater competition from providers and higher annuity rates in March 2023.

|

|

|

|

|

|

|

| |

Age |

Single |

Joint |

|

|

| |

55 |

£6,654 |

£6,281 |

|

|

| |

60 |

£7,014 |

£6,666 |

|

|

| |

65 |

£7,652 |

£7,219 |

|

|

| |

70 |

£8,619 |

£7,918 |

|

|

£100,000 purchase, level rates, standard

Unisex rates and joint life basis |

|

|

|

|

|

| |

Plan your annuity and get quotes from the 12 leading providers |

|

| |

| |

|

Free Annuity Quotes |

| |

|

No Obligation |

| |

|

From All Providers |

|

|

|

|

|

|

|

|

|

| You can follow the latest annuity updates on Twitter or as a fan on Facebook |

|

| |

|

|

|

|

|