|

21 November 2022 last updated |

|

| Retirement income up 104pc in two years as annuities hit record high |

|

| |

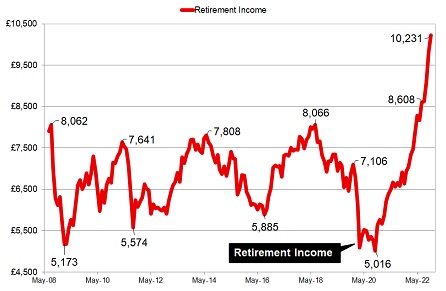

Retirement income is up 103.9% with soaring annuity rates and improving FTSE-100 index. |

|

|

|

|

|

Retirement income is up 104% since the low during the Covid pandemic due to higher base rates from the Bank of England and fallout from the mini budget.

The buying power of a pension fund reached a low of £5,016 pa in October 2020 increasing to a record high of £10,231 pa in November 2022 up 103.9% as markets react to the mini budget shock and future likely rise in base rates from central banks.

Our benchmark example records the buying power of a pension over time starting with a fund of £100,000 in July 2008 tracking the FTSE-100

index.

This is combined with annuity rates for each month based on a 65 year old in good health buying a lifetime

annuity on a single life and level basis, starting with an annuity in July 2008 of £7,908 pa.

Find related news here:

Pension annuities up 47pc this year with extra help from Mini Budget

Retirement income at record high as gilts and pension annuities soar

This chart below shows how the buying power of a pension fund has changed over time. It starts in June 2008 when a fund of £100,000 tracking the FTSE-100 index and could offer a retirement income of £7,908 pa based on annuity rates at that time. With rises and falls in fund value and annuity rates, this is the income that could be generated.

|

| |

Benchmark annuity rates and FTSE-100 index |

|

| |

May |

Jun |

Jul |

Aug |

Sep |

Oct |

Nov |

| FTSE |

7,607 |

7,172 |

7,413 |

7,361 |

6,889 |

7,107 |

7,385 |

| Rate |

£5,893 |

£6,169 |

£6,283 |

£6,338 |

£7,137 |

£7,474 |

£7,496 |

|

Fig 1: Chart and table comparing retirement income from 2008 to 2022 |

The Covid pandemic resulted in 15-year gilt yields reducing to an all time low of 0.162% in March 2020 and remaining at an average of 0.50% for the rest of the year. The FTSE-100 index reached a low of 5,577 in October 2020 with the threat of further lockdowns in Europe winter and no vaccine developed at that time.

By October annuity rates were as low as £4,867 pa based benchmark example are based on a 65 year old in good health buying a lifetime

annuity with £100,000 on a single life and level basis.

All these factors combined to reduce the buying power to an all time low of £5,016 pa, having started at £7,908 pa in July 2008.

The 15-year gilt yields started the year at 1.14% and due to central banks raising base rates and the mini budget this has increase 245 basis points to 3.59%. Yields reached a fourteen high on 12 October 2022 of 5.09% before reducing back to more normal levels after the appointment of Prime Minister Rishi Sunak.

As a result of the mini budget on 23 September 2022, the table above shows how rapidly annuity rates increased and still remain at record high levels for our benchmark example of £7,496 pa.

Annuity rates have increased 47.4% this year compared to 15-year gilt yields rising 24.5%. This suggests providers have priced-in further increases in base rates and yields in the next six months.

If this is the case annuity rates may remain level or decrease in the future and now is a good time to lock-in record high annuity rates and secure guaranteed income in your portfolio.

The Bank of England raised base rates by 0.75% with interest rates now at 3.00% and intend to increase this further in December. The Governor of the Bank of England Andrew Bailey stated at the latest meeting on 3 November 2022 the expectation of inflation remaining high until June 2023 and reducing rapidly thereafter.

If this is the case, gilt yields will reduce before this date along with annuity rates and there is a limited time to secure annuity rates at the current record levels.

Once you secure an annuity it is guaranteed for your lifetime and is effectively a 47% pay rise on average for pensioners taking benefits at retirement compared to the historically low levels.

To find out how the record rise in annuity rates has increased your retirement income for your age, click this link annuity rates table.

|

|

|

|

|

|

|

| |

Age |

Single |

Joint |

|

|

| |

55 |

£6,654 |

£6,281 |

|

|

| |

60 |

£7,014 |

£6,666 |

|

|

| |

65 |

£7,652 |

£7,219 |

|

|

| |

70 |

£8,619 |

£7,918 |

|

|

£100,000 purchase, level rates, standard

Unisex rates and joint life basis |

|

|

|

|

|

| |

Plan your annuity and get quotes from the 12 leading providers |

|

| |

| |

|

Free Annuity Quotes |

| |

|

No Obligation |

| |

|

From All Providers |

|

|

|

|

|

|

|

|

|

| You can follow the latest annuity updates on Twitter or as a fan on Facebook |

|

| |

|

|

|

|

|