|

19 December 2025 last updated |

|

| Annuities could rise even after Bank of England lowers interest rates to 3.75pc |

|

| |

Gilt yields rise 10 basis points to 4.94% after the Bank of England reduces interest rates to 3.75%. |

|

|

|

|

|

Annuities could rise 2% as gilt yields end the week ten basis points higher even after the Bank of England reduce interest rates by a quarter percent to 3.75%.

The Bank of England reduced interest rates by a quarter percent from 4.0% to 3.75% following weaker economic data and lower than expected inflation figure for November falling to 3.2%.

The Monetary Policy Committee decision was close with with five members including Governor Bailey voting for the reduction and four members voting against.

Despite lower interest rates, the 15-year gilt yields increased by +10 basis points to 4.94% by the end of the week with investors expecting fewer reductions in interest rates going forward.

Find related news here:

Annuity rates fall 2pc with lower yields as investors positive after Budget

Gilt yields fall to 4.81pc the lowest point in a year reducing annuities

This means providers could increase annuities by over +2% in the first quarter of 2026 should gilt yields remain at current levels.

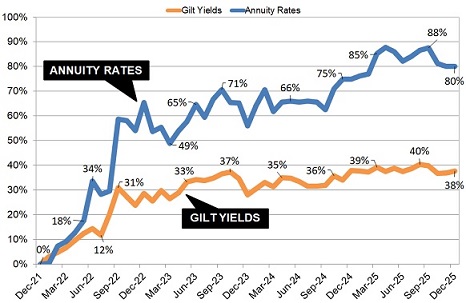

For annuity rates our benchmark example was at a recent high of £5,100 pa in September 2025 and reduced -3.98% to £4,897 pa at the beginning of December as gilt yields fell from recent highs. This is based on a 60 year old using £100,000 to purchase a single life annuity and 3% escalation basis.

Depending on age and features, annuity rate increases since the low in December 2021 as high as 111% for our benchmark example aged 55 years using £100,000 to purchase a 50% joint life and 3% escalation income.

|

| Fig 1: Chart comparing annuity rates and 15-year gilt yields |

The above chart shows our benchmark example for a 60 year old using £100,000 to purchase a single life and 3% escalating income is currently at £4,897 pa and this income is +80% higher than the recent low in December 2021.

The Bank of England's governor Andrew Bailey has said the interest rates are on a gradual downward path and further cuts will be a closer call.

In the US the Federal Reserve has cut interest rates by -0.25% in December 2025 to a range of 3.50% to 3.75%, the third cut this year.

Even so, the Federal Open Committee was split nine-to-three to reduce interest rates.

There remains uncertainty due to the impact of tariffs, changes in the labour market and immigration crackdown. The Fed chair Jerome Powell has emphasized the need to be careful with interest rate decisions as the government shutdown has impacted data collection.

The combination of US and UK

central bank caution about reducing rates suggests interest rates will remain higher for longer and gilt yields are rising to reflect this position, at least in the short term.

Providers reduced annuity rates after the peak in September and now have the scope to increase annuity rates by +2% in the first quarter of 2026 if 15-year gilt yields remain at current 4.94% level.

|

|

|

|

|

|

|

| |

Age |

Single |

Joint |

|

|

| |

55 |

£6,654 |

£6,281 |

|

|

| |

60 |

£7,014 |

£6,666 |

|

|

| |

65 |

£7,652 |

£7,219 |

|

|

| |

70 |

£8,619 |

£7,918 |

|

|

£100,000 purchase, level rates, standard

Unisex rates and joint life basis |

|

|

|

|

|

| |

Plan your annuity and get quotes from the 12 leading providers |

|

| |

| |

|

Free Annuity Quotes |

| |

|

No Obligation |

| |

|

From All Providers |

|

|

|

|

|

|

|

|

|

| You can follow the latest annuity updates on Twitter or as a fan on Facebook |

|

| |

|

|

|

|

|