|

7 February 2020 last updated |

|

| Annuity rates lower as demand for safe havens rise on coronavirus fears |

|

| |

Gilt yields fall 31 basis points after fears the coronavirus will spread, impacting the global economy. |

|

|

|

|

|

The recovery in annuity rates could reverse as investor demand for safe havens rises with fears over coronavirus spreading to countries beyond China.

Investor demand for safe havens has seen 15-year gilt yields reduce 27 basis points in January as case with coronavirus spread beyond China with cases reported in the US and France.

This usually means providers reducing annuity rates by about -2.7% shortly after the fall in gilt yields.

The World Health Organization has declared the coronavirus a global health emergency the Chinese authorities attempt to contain the outbreak with travel and trade restrictions.

|

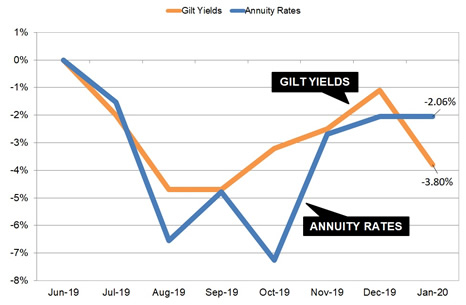

| Fig 1: Chart comparing standard annuity rates and 15-year gilt yields |

The above chart shows annuity rates for for the last seven months which are down -2.06% for the year. This compares to -3.80% fall of the 15-year gilt yields.

Gilt yields reached an all time low in September of 0.566% and increased 51 basis points to 1.07% on 31 December 2019. The recovery was due to the significant majority by the Conservatives and the US and China reach phase one of a trade deal.

| |

Annuity rates and gilt yields |

|

| |

Jul |

Aug |

Sep |

Oct |

Nov |

Dec |

Jan |

| Rate |

£5,053 |

£4,891 |

£4,956 |

£4,827 |

£5,065 |

£5,098 |

£5,032 |

| Yield |

0.98% |

0.71% |

0.71% |

0.86% |

0.93% |

1.07% |

0.76% |

|

The chart and table are based on our benchmark example of a person aged 65 year old with a £100,000 fund. In January 2019 they could purchase an annuity on a single life, level basis with retirement income of £5,571 pa and this has reduced by 9.6% or -£539 pa a year later with an income of £5,032 pa.

In terms of total income during their life, the Office of National Statistics (ONS) would expect a male to live for 18.5 years and he will have -£9,971 less over his lifetime. For a female she can expected to live for 20.9 years decreasing her lifetime income by -£11,265.

Annuities had made a recovery since our benchmark reached a recent low of £4,827 pa in October and increase 5.6% or £271 pa showing providers had confidence of rising gilt yields which improved 50 basis points from the all time low of 0.566% to 1.07% by December 2019.

The coronavirus introduces a new unexpected threat of spreading beyond China to other countries with a significant impact on the global economy with restricted travel and trade.

Until there is evidence the coronavirus is not spreading at an increasing rate, investors will seek the safety of bonds and gilts resulting in yields staying low with annuity rates remaining subdued.

|

| |

|

|

|

|

|

|

|

| |

Age |

Single |

Joint |

|

|

| |

55 |

£6,132 |

£5,784 |

|

|

| |

60 |

£6,532 |

£6,234 |

|

|

| |

65 |

£7,247 |

£6,808 |

|

|

| |

70 |

£8,170 |

£7,616 |

|

|

£100,000 purchase, level rates, standard

Unisex rates and joint life basis |

|

|

|

|

|

| |

Plan your annuity and get quotes from the 12 leading providers |

|

| |

| |

|

Free Annuity Quotes |

| |

|

No Obligation |

| |

|

From All Providers |

|

|

|

|

|

|

|

|

|

| You can follow the latest annuity updates on Twitter or as a fan on Facebook |

|

| |

|

|

|

|

|