|

9 March 2020 last updated |

|

| Pension annuities risk as oil price fall sends yields to all time lows |

|

| |

Gilt yields reduce by 50 basis points to an all time low of 0.18% after oil prices fall to $35 a barrel. |

|

|

|

|

|

Pension annuities are at risk of reductions as gilt yields reach an all time low following the plunge in oil prices due as Saudi Arabia and Russia enter a price war.

The 15-year gilt yields have reduced to an all time low of 0.162% reducing 50 basis points in March. For the year yields are lower by 91 basis points having started the year at 1.07% due to the combination of coronavirus threat to global growth and now the oil price war.

Find related news here:

Gilt yields fall as coronavirus threatens slowdown for global growth

Retirement income at decade low with panic selling on equity markets

Annuity rates are mainly based on the 15-year gilt yields and a fall of 50 basis could see rates reduce by up to 5.0% although providers have not yet reacted to the latest falls.

It is expected that Saudi Arabia and Russia will increase the level of oil production significantly this month as they failed to reach an agreement to cut output to stabilise prices at a meeting in Vienna last weekend between OPEC and allies.

Saudi Arabia has reduced their official selling price for their oil sending global oil prices lower by 33% followed by equity markets in Asia and Europe tumbling. The FTSE-100 index down by up to 8% to 5,903, a level last reached in January 2013 and the worst day since the financial crisis in 2008.

|

| |

Annuity rates and gilt yields |

|

| |

Sep |

Oct |

Nov |

Dec |

Jan |

Feb |

Mar |

| Rate |

£4,956 |

£4,827 |

£5,065 |

£5,098 |

£5,032 |

£5,027 |

£5,027 |

| Yield |

0.71% |

0.86% |

0.93% |

1.07% |

0.76% |

0.66% |

0.30% |

|

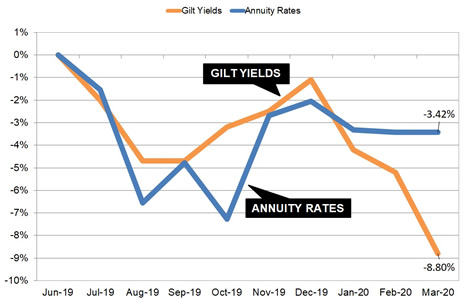

Fig 1: Chart and table comparing standard annuity rates and 15-year gilt yields |

The above chart and table are based on our benchmark example of a person aged 65 year old with a £100,000 fund. Annuity rates reached a low in October of £4,827 pa following the fall in gilt yields to 0.566% with trade tensions continuing to build between the US and China.

Annuities recovered after the general election and have been steady in the first few months of 2020. In the short term there is likely to be volatility for pension annuities as investors seek the safety of bonds and gilts.

In addition to the fear surrounding coronavirus and move to safe havens, an oil price war adds to the concern of global recession and an expectation of slowing inflation which also adds to the downward pressure on yields.

Pension annuities are likely to fall in the short term and remain at current levels if yields recover to above 0.75%. A longer term oil price war would create pressure on Gross Domestic Product (GDP) of oil producing countries including Russia, Saudi Arabia and the US shale oil industry in addition to the impact of the coronavirus.

|

| |

|

|

|

|

|

|

|

| |

Age |

Single |

Joint |

|

|

| |

55 |

£6,132 |

£5,784 |

|

|

| |

60 |

£6,532 |

£6,234 |

|

|

| |

65 |

£7,247 |

£6,808 |

|

|

| |

70 |

£8,170 |

£7,616 |

|

|

£100,000 purchase, level rates, standard

Unisex rates and joint life basis |

|

|

|

|

|

| |

Plan your annuity and get quotes from the 12 leading providers |

|

| |

| |

|

Free Annuity Quotes |

| |

|

No Obligation |

| |

|

From All Providers |

|

|

|

|

|

|

|

|

|

| You can follow the latest annuity updates on Twitter or as a fan on Facebook |

|

| |

|

|

|

|

|