|

30 November 2015 last updated

|

|

| Annuities sold now 75% lower than before pension freedoms |

|

The number of annuities have reduced by 75% following the introduction of the pension freedom according to data released by the ABI as people take their fund as cash or use flexi-access drawdown.

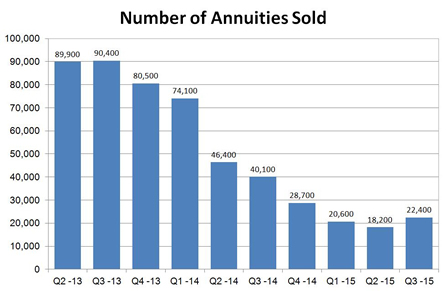

The Association of British Insurers (ABI) data shows that over the last two years the number of annuities sold have decreased from 90,414 in the third quarter of 2013 to 22,380 in the same quarter 2015 or 75.2% decrease.

Since the pension freedoms in April this year £4.7 billion has been withdrawn from pension funds. Most of the small funds have being taken as cash.

A further £5.0 billion was used to provide retirement income with 84,500 regular income products such as annuities, fixed term plan or flexi-access drawdown.

Annuity sales have shown their first increase since the third quarter 2012 although remain at a very low level. Sales have increased from 18,200 last quarter valued at £990 million to 22,380 in the third quarter valued at £1.17 billion.

|

|

|

| |

The number of annuities sold has reduced by 75% as people opt for cash or drawdown options |

|

|

|

| |

|

More people taking flexi-access drawdown

The greater flexibility offered by the pension freedoms has resulted in more people taking their pension as flexi-access drawdown. The following chart shows how the overall market for annuities has drastically reduced in the last few years.

|

| Fig 1: Chart showing the fall in annuity sales over two years |

For the funds invested of £5.0 billion since April the ABI has said £2.2 billion has been used to buy 40,600 annuities making an average fund size of £53,300. Another £2.8 billion has been used to to invest in

drawdown products with an average fund size of £65,000.

From the data about 40% of people buying an annuity use the open market option to take the fund with another provider. For flexi-access drawdown this increases to 60% taking their fund to a new provider.

Pension funds taken as cash or income

There are £4.7 billion that is take from the existing provider either as cash or income payout. About £2.5 billion is paid out as cash lump sums as 166,700 transactions with an average of £15,000 predominately smaller funds. There was another £2.2 billion paid out in 606,000 income payments with an average of £3,600.

The ABI’s Director for Long Terms Savings Policy, Dr Yvonne Braun, has said an increasing number of people are recognising the value of a guaranteed income, with annuity sales rising this quarter.

There are also initial signs that the number of people accessing their pension pot as cash is beginning to settle down, with larger pots continuing to be used to buy retirement income products.

|

|

|

|

|

|

|

|

| |

Age |

Single |

Joint |

|

|

| |

55 |

£6,654 |

£6,281 |

|

|

| |

60 |

£7,014 |

£6,666 |

|

|

| |

65 |

£7,652 |

£7,219 |

|

|

| |

70 |

£8,619 |

£7,918 |

|

|

£100,000 purchase, level rates, standard

Unisex rates and joint life basis |

|

|

|

|

|

| |

Plan your annuity and get quotes from the 12 leading providers |

|

| |

| |

|

Free Annuity Quotes |

| |

|

No Obligation |

| |

|

From All Providers |

|

|

|

|

|

|

|

|

|

| You can follow the latest annuity updates on Twitter or as a fan on Facebook |

|

| |

|

|

|

|

|