|

| 8 May 2015 last updated |

|

| Pension annuities to benefit from investors dumping gilts |

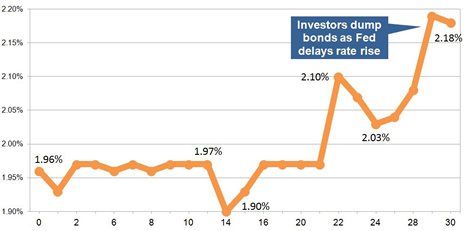

| 15-year gilt yields chart |

| Based on figures for April 2015 |

|

| |

Pension annuities are to benefit next month from the sudden 22 basis point rise in yields to 2.18% after the Federal Reserve delayed increasing interest rates and investors dumped government bonds.

| Standard rates: |

|

|

0.43% |

|

| Enhanced rates: |

|

|

1.26% |

|

| Gilt yields: |

|

|

22 basis point |

|

|

|

|

| Federal Reserve delay good for annuity rates

The decision by the Federal Reserve to delay a rise in interest rates has resulted with investors dumping US Treasury notes, German Bunds and UK gilts. Other factors driving investor action was less gloomy data from Europe, failure of a German five-year debt auction and over supply of US bonds.

Standard providers were higher by an average of

0.43% and we would expect to see an increase of 1.77% in the short term and in the medium term of 3 months annuity rates will increase by 4.41%.

Smoker and enhanced annuity providers increased their rates by 1.26% on average with an increase of 0.94% possible in the short term and in the medium term of 3 months we can expect an increase of 7.35%.

Equity markets started at 6,855 and increased by 106 points to end at 6,961.

Fig 1 below shows the annuity rates changes for the whole market and the proportion that have either increased, decreased or or did not change. It also shows the range of the changes of the annuity rates over the last month:

| Annuity Rates Changes |

| Increase |

No change |

Decrease |

|

|

71% |

|

|

|

|

12% |

|

|

|

|

17% |

|

|

Increases of:

up to 4.5%

|

|

Decreases of:

up to 2.8% |

|

| |

Fig 1: Annuity rate changes for the whole market |

|

The majority of rates increased with 71% rising, 12% remaining unchanged and 17% decreasing.

What happened to standard rates

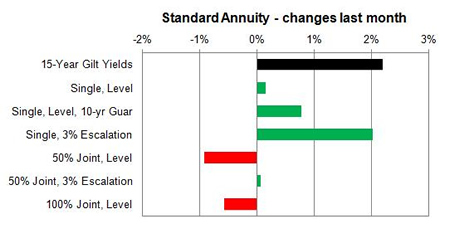

Below shows a fund of £100,000 with the change in standard annuity rates for single and joint pensioners from age 55 to 75 with different annuity options such as level or escalating over 1 month compared to gilt yields:

|

| Fig 2: Change in standard rates last month compared to gilt yields |

Standard annuities were mixed this month with single life, 3% escalating rates up 2.03% in contrast to 50% joint life rates decreasing by 0.92% and 100% joint life by 0.57%. Other decreases were single and joint life for those aged 55 lower by 2.8%.

The highest increase was for those aged 60, single life, level rates higher by 3.4% and single life aged 60 to 70 with 3% escalation higher by up to 4.5%.

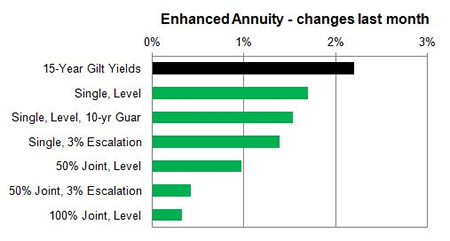

What happened to enhanced rates

Lifestyle smoker and enhanced annuities have decreased significantly across the board for all types of annuities and ages.

|

| Fig 3: Change in enhanced rates last month compared to gilt yields |

For enhanced and smoker rates were strongly up across the board with the highest increases of 2.3% for single life rates aged 55, 65 and 70. The lowest improvements were for joint life annuities.

For the latest updates see Annuity Rates Review.

Changes to the 15-year gilt yields

The yields change for the month was from 1.96% to 2.18% or 22 basis points. Fig 2 below shows the daily 15-year gilt yields and the increase or decrease from the previous day's close:

| 15-Year Gilt Yields - April 2015 |

| |

|

Wed 1st |

Thurs 2nd |

Fri 3rd |

| |

|

| 1.93% |

|

|

0.03 |

|

| 1.97% |

|

|

0.04 |

|

| 1.97% |

|

|

| Mon 6th |

Tues 7th |

Wed 8th |

Thurs 9th |

Fri 10th |

| 1.96% |

|

|

0.01 |

|

| 1.97% |

|

|

0.01 |

|

| 1.96% |

|

|

0.01 |

|

| 1.97% |

|

|

0.01 |

|

| 1.97% |

|

|

| Mon 13th |

Tues 14th |

Wed 15th |

Thurs 16th |

Fri 17th |

| 1.97% |

|

|

| 1.90% |

|

|

0.07 |

|

| 1.93% |

|

|

0.03 |

|

| 1.97% |

|

|

0.04 |

|

| 1.97% |

|

|

| Mon 20th |

Tues 21st |

Wed 22nd |

Thurs 23rd |

Fri 24th |

| 1.97% |

|

|

| 1.97% |

|

|

| 2.10% |

|

|

0.13 |

|

| 2.07% |

|

|

0.03 |

|

| 2.03% |

|

|

0.04 |

|

| Mon 27th |

Tues 28th |

Wed 29th |

Thurs 30th |

|

| 2.04% |

|

|

0.01 |

|

| 2.08% |

|

|

0.04 |

|

| 2.19% |

|

|

0.11 |

|

| 2.18% |

|

|

0.01 |

|

|

|

| |

Fig 2: Daily 15-year gilt yields and changes |

|

|

|

|

|

|

|

|

|

| |

Age |

Single |

Joint |

|

|

| |

55 |

£6,654 |

£6,281 |

|

|

| |

60 |

£7,014 |

£6,666 |

|

|

| |

65 |

£7,652 |

£7,219 |

|

|

| |

70 |

£8,619 |

£7,918 |

|

|

£100,000 purchase, level rates, standard

Unisex rates and joint life basis |

|

|

|

|

|

| |

Plan your annuity and get quotes from the 12 leading providers |

|

| |

| |

|

Free Annuity Quotes |

| |

|

No Obligation |

| |

|

From All Providers |

|

|

|

|

|

|

|

|

|

| You can follow the latest annuity updates on Twitter or as a fan on Facebook |

|

| |

|

|

|

|

|