|

| 2 November 2013 last updated |

|

| Annuities fall as investors expect more Fed stimulus lowering gilt yields |

| 15-year gilt yields chart |

| Based on figures for October 2013 |

|

| |

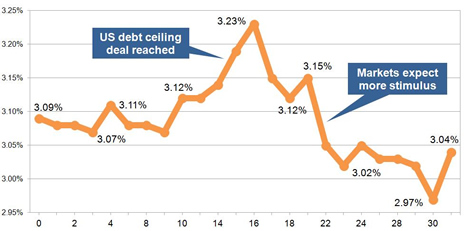

15-year gilt yields recovered during the month after the US debt ceiling deal was reached only to lower as investors expect the Fed stimulus to continue sending annuities lower as standard providers correct their rates.

| Standard rates: |

|

|

2.90% |

|

| Enhanced rates: |

|

|

0.74% |

|

| Gilt yields: |

|

|

5 basis points |

|

|

|

|

Standard annuity rates ready for a fall

15-year gilt yields ended the month 5 basis points lower at 3.04% although had reached a low point of 2.97%. As a general rule a 5 basis point fall would see annuity rates decrease by 0.5%, however, in September providers were behind changing yields and needed to catch up in October.

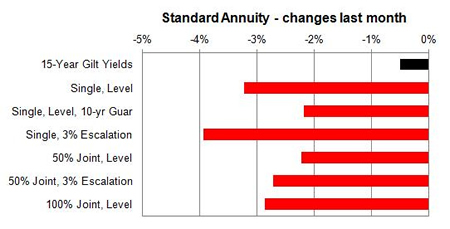

Standard annuity providers have reduced their rates by

2.90% and in the medium term of three months are closely matching yields. Over this time period yields are higher by 11 basis points and we would expect annuities to be higher by 1.1%. In fact they are higher by 1.24% so we would expect a slight fall of only 0.14%.

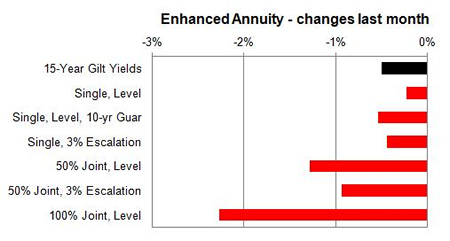

Enhanced and smoker annuity providers reduced their rates by 0.74% during the month and over three months have increased by 0.74% compared to yields at 11 basis points so could increase slightly by about 0.36%.

Fig 1 below shows the annuity rates changes for the whole market and the proportion that have either increased, decreased or or did not change. It also shows the range of the changes of the annuity rates over the last month:

| Annuity Rates Changes |

| Increase |

No change |

Decrease |

|

|

1% |

|

|

|

|

11% |

|

|

|

|

88% |

|

|

Increases of:

0% - 0.4%

|

|

Decreases of:

0.1%-5.9% |

|

| |

Fig 1: Annuity rate changes for the whole market |

|

There was only 1% that increased for the month and 88% of annuities decreased with 11% remaining unchanged. Of the decreases the range was a fall of between 0.1% and 5.9%.

The largest decreases were for older standard annuitants aged about 75 years. As an example the largest monetary reductions were for single lives aged 75 and with a fund of £100,000 buying a level annuity the income has reduced by £451 pa to £7,967 pa.

Enhanced and smoker rates were mainly lower slightly lower across the board with some larger decreases for those aged 55 to 60 on a joint life basis.

Equity markets started at 6,462 and increased 269 points to end at 6,731. This represents a 4.1% increase and for people that remain invested have seen their fund rise in value which would counter the fall in pension annuity rates.

What happened to standard rates

Below shows a fund of £100,000 with the change in standard annuity rates for single and joint pensioners from age 55 to 75 with different annuity options such as level or escalating over 1 month compared to gilt yields:

|

| Fig 2: Change in standard rates last month compared to gilt yields |

All standard annuities decreased following the medium fall in the 15-year gilt yields and the slow reaction of providers has now resulted in a significant correction.

What happened to enhanced rates

Lifestyle smoker and enhanced annuities have decreased in line with the fall in gilt yields and in particular for joint life rates.

|

| Fig 3: Change in enhanced rates last month compared to gilt yields |

For smoker and enhanced annuity rates on the 100% joint life decreased the most by 2.27% as they rose the previous month against the trend in yields.

All the leading impaired providers have reduced their rates although Just Retirement has maintained higher annuity rate levels than Liverpool Victoria and Partnership. See Annuity Rates Review For the latest updates.

Changes to the 15-year gilt yields

Gilt yields have suffered this month from volatility after uncertainty in the US over the continuing debt ceiling crisis and stimulus package.

Initially when the debt ceiling deal was reached yields increased to 3.23% on their way to a recovery. However, investors turned their attention to the $85 billion a month stimulus package and bet on this continuing well into 2014.

As a result yields quickly fell to 2.97% although there was a reversal on the last day of the month of 7 basis points ending with 3.04% after the Federal Reserve maintained stimulus but did not state a poor economy was the reason, suggesting it may be possible that the stimulus will be tapered in December.

For October the yields range for the month was from 2.97% to 3.23% or 26 basis points which is more volatile than previous months although both standard and smoker and enhanced annuities are well balanced with yields. Fig 2 below shows the daily 15-year gilt yields and the increase or decrease from the previous day's close:

| 15-Year Gilt Yields - October 2013 |

| |

Tues 1st |

Wed 2nd |

Thurs 3rd |

Fri 4th |

| |

| 3.08% |

|

|

0.01 |

|

| 3.08% |

|

|

| 3.07% |

|

|

0.01 |

|

| 3.11% |

|

|

0.04 |

|

| Mon 7th |

Tues 8th |

Wed 9th |

Thurs 10th |

Fri 11th |

| 3.08% |

|

|

0.03 |

|

| 3.08% |

|

|

| 3.07% |

|

|

0.01 |

|

| 3.12% |

|

|

0.05 |

|

| 3.12% |

|

|

| Mon 14th |

Tues 15th |

Wed 16th |

Thurs 17th |

Fri 18th |

| 3.14% |

|

|

0.02 |

|

| 3.19% |

|

|

0.05 |

|

| 3.23% |

|

|

0.04 |

|

| 3.15% |

|

|

0.08 |

|

| 3.12% |

|

|

0.03 |

|

| Mon 21st |

Tues 23rd |

Wed 24th |

Thurs 25th |

Fri 26th |

| 3.15% |

|

|

0.03 |

|

| 3.05% |

|

|

0.10 |

|

| 3.02% |

|

|

0.03 |

|

| 3.05% |

|

|

0.03 |

|

| 3.03% |

|

|

0.02 |

|

| Mon 28th |

Tues 29th |

Wed 30th |

Thurs 31st |

|

| 3.03% |

|

|

| 3.02% |

|

|

0.1 |

|

| 2.97% |

|

|

0.10 |

|

| 3.04% |

|

|

0.07 |

|

|

|

| |

Fig 2: Daily 15-year gilt yields and changes |

|

|

|

|

|

|

|

|

|

| |

Age |

Single |

Joint |

|

|

| |

55 |

£6,654 |

£6,281 |

|

|

| |

60 |

£7,014 |

£6,666 |

|

|

| |

65 |

£7,652 |

£7,219 |

|

|

| |

70 |

£8,619 |

£7,918 |

|

|

£100,000 purchase, level rates, standard

Unisex rates and joint life basis |

|

|

|

|

|

| |

Plan your annuity and get quotes from the 12 leading providers |

|

| |

| |

|

Free Annuity Quotes |

| |

|

No Obligation |

| |

|

From All Providers |

|

|

|

|

|

|

|

|

|

| You can follow the latest annuity updates on Twitter or as a fan on Facebook |

|

| |

|

|

|

|

|