|

| 31 July 2013 last updated |

|

| Annuity Rates - July 2013 |

|

Annuities continue to edge upwards as gilt yields find a new higher level following the Federal Reserve plan to taper QE later this year.

| Standard rates: |

|

|

3.10% |

|

| Enhanced rates: |

|

|

0.86% |

|

Strong increase in standard annuity rates from Legal & General, Aviva and Canada Life have seen an average increase of 3.10% in the month with a smaller improvement in smoker and enhanced annuity rates of 0.86%.

The 15-year gilt yields decreased by 6 basis points last month and as a general rule this would mean annuity rates falling by 0.6%.

However, as rates continuing to rise there is a risk of a fall in the short term should yields reduce next month as annuities are up more than expected. The providers may be expecting further improvements in yields based on the US Federal Reserve position over their stimulus plan and therefore are willing to be more competitive in the short term. |

|

|

| |

Annuities still increase even though yields are lower after the US Fed expect QE to continue |

|

|

|

| |

|

More opportunity in medium term for increases

15-year gilt yields increased 71 basis points over three months and we would expect a 7.1% increase in pension annuities. Over this time period annuities are higher by 5.96% on average suggesting there is room for improvement of about 1.14%.

In the short term though, one month, we would expect standard rates to decrease 3.70% on average with lifestyle enhanced and smoker annuities decreasing by 1.46% on average.

Fig 1 below shows the annuity rates changes for the whole market and the proportion that have either increased, decreased or or did not change. It also shows the range of the changes of the annuity rates over the last month:

| Annuity Rates Changes |

| Increase |

No change |

Decrease |

|

|

90% |

|

|

|

|

0% |

|

|

|

|

10% |

|

|

Increases of:

0.4% - 8.5%

|

|

Decreases of:

0.5%-0.8% |

|

| |

Fig 1: Annuity rate changes for the whole market |

|

This month 90% of annuities increased for both standard, enhanced and smoker rates by between 0.4% and 8.5%. The biggest increases have been from standard single life, 3% escalation rates for those aged 75 increasing by 8.58% whereas the majority have increased by 2-3% for the month. Smoker and enhanced annuities have shown increases of 1-2% with decreases of about 0.7% for the majority of annuitants aged 75.

Equity markets started at 6,215 and increased 406 points to end at 6,621. This represents a 6.5% increase and for people that remain invested have gained from a rise in their fund and also the increase in pension annuity rates.

What happened to standard rates

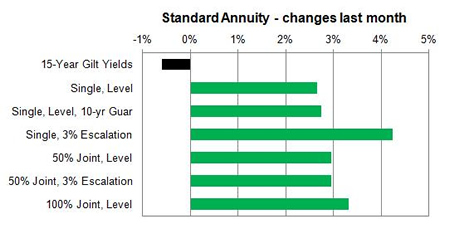

Below shows a fund of £100,000 with the change in standard annuity rates for single and joint pensioners from age 55 to 75 with different annuity options such as level or escalating over 1 month compared to gilt yields:

|

| Fig 2: Change in standard rates last month compared to gilt yields |

Standard annuities have increased rates consistently across the different types of annuity features with a peak from the single life, 3% escalating annuity. The following chart shows the three month changes.

|

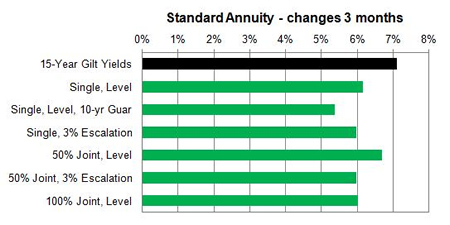

| Fig 3: Change in standard rates last 3 months compared to gilt yields |

Over the last three months all annuity rates are slightly behind the rise in 15-year gilt yields and on average could improve by a further 1.14% assuming yields do not change over time.

What happened to enhanced rates

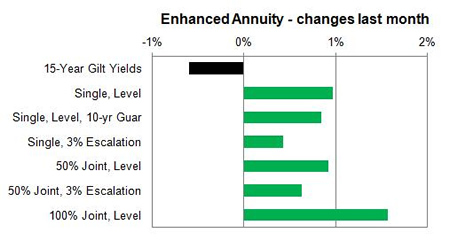

Lifestyle smoker and enhanced annuities have increased the most and all annuities have exceed the rise in yields. In the short term it is likely that annuity rates will decrease slightly especially if yields drift back down as can be seen in the following chart.

|

| Fig 4: Change in enhanced rates last month compared to gilt yields |

In the short term smoker and enhanced annuity rates have increased slightly while yields have reduced. For 100% joint life and level annuities the increase has been greater although there are bigger differences in the following chart for three month changes.

|

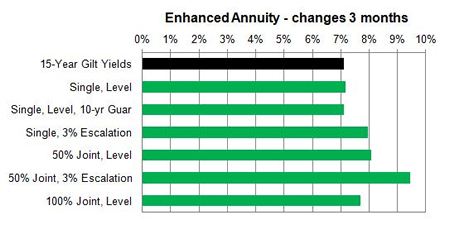

| Fig 5: Change in enhanced rates last 3 months compared to gilt yields |

Over three months 50% joint life with 3% escalation has increased the most by 9.45% with the single life annuities being very similar to the rise in yields over this time.

The impaired providers are more competitive than the standard providers with Just Retirement, Liverpool Victoria and Partnership leading the market. See Annuity Rates Review For the latest updates.

|

|

|

|

|

|

|

|

| |

Age |

Single |

Joint |

|

|

| |

55 |

£6,654 |

£6,281 |

|

|

| |

60 |

£7,014 |

£6,666 |

|

|

| |

65 |

£7,652 |

£7,219 |

|

|

| |

70 |

£8,619 |

£7,918 |

|

|

£100,000 purchase, level rates, standard

Unisex rates and joint life basis |

|

|

|

|

|

| |

Plan your annuity and get quotes from the 12 leading providers |

|

| |

| |

|

Free Annuity Quotes |

| |

|

No Obligation |

| |

|

From All Providers |

|

|

|

|

|

|

|

|

|

| You can follow the latest annuity updates on Twitter or as a fan on Facebook |

|

| |

|

|

|

|

|