|

| 4 September 2014 last updated |

|

| Annuity rates fall 2.3% as yields lower on Eurozone deflation crisis |

|

The latest annuity rates recovery has ended with falls in the 15-year gilt yields as the threat from Eurozone deflation sends rates to new lows and for the first time the year-on-year change is now negative.

In January 2013 annuity rates reached an all time low and for our benchmark example of a 65 year old with a fund of £100,000 the income was £5,373 pa.

Since July 2013 annuities have only experienced year-on-year gains and this ended in August with the first decline.

Annuity rates are mainly based on the 15-year gilt yields which have decreased by 35 basis points last month. As a general rule a 35 basis point change would result in a fall in annuities of 3.5%.

More declines are expected as gilt yields are in a downward cycle in particular following the deepening Eurozone crisis over deflation.

Investors are concerned the European Central Bank (ECB) will consider Quantitative Easing sending gilt yields much lower.

|

|

|

| |

Threat of stimulus plan by Eurozone to counter deflation

ends annuity rates recovery |

|

|

|

| |

|

Annuity rates fall 2.3% with lower yields

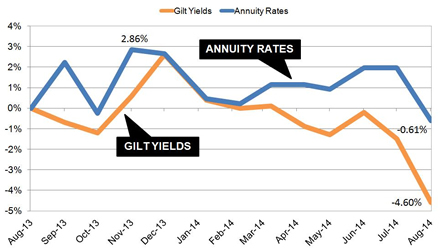

Standard annuity rates fell 2.3% last month following lower gilt yields and the following chart shows how annuities are now lower than they were a year ago. Providers can no longer resist the downward movement of gilt yields.

|

| Fig 1: Chart comparing annuity rates and 15-year gilt yields |

Providers have been resisting the downward movement in yields since the government announced the new pension rules in the Budget, to be introduced from April 2015 as Flexi-Access Drawdown.

The gap between rates and yields has been growing and finally providers have reacted and lowered annuities. Even after the average fall in rates of 2.3% there is still a significant gap and annuities are likely to continue to fall.

For our benchmark example for a person aged 65 with a fund of £100,000 could have purchased a single life, level annuity with an income of £6,135 pa and this has now reduced by £148 pa to £5,987 pa. In terms of lifetime income, the Office of National Statistics (ONS) would expect a male to live for 17.3 years and he will have £2,560 less over his lifetime. For a female she can expected to live for 20.4 years decreasing her income by £3,019.

Eurozone deflation crisis to continue

Inflation has slipped to a five year low in the Eurozone at 0.9% and figures from the statistics agency Eurostat show that prices inflation has reduced to only 0.3% after falling continuously from 2.0% in January 2013.

Chairman of the European Central Bank (ECB) Mario Draghi has kept away form Quantitative Easing especially as Germany's politicians are against the method after disastrous consequences of printing money by Germany between the First and Second World Wars.

The risks of deflation are high as can be seen from Japan's decade of stagnation and deflation. Markets are hopeful that the ECB will look to QE to help reverse the Eurozone fall towards deflation as this would improve liquidity in equity markets. This is at time the Federal Reserves is reducing its stimulus programme down from $85 billion per month to $25 billion.

If the Eurozone does resort to Quantitative Easing

it may take some time for gilt yields to recover from the current low of 2.70%. As an alternative to an annuity to give more time for a recovery, people retiring can use a fixed term annuity. This offers terms of one year or more with an income selected by you and a guaranteed maturity amount at the end of the term.

An alternative would be flexible drawdown that offers the greatest flexibility where an income or cash sums can be taken at any time and is accessible even with smaller funds from £30,000 or more.

|

|

|

|

|

|

|

|

| |

Age |

Single |

Joint |

|

|

| |

55 |

£6,654 |

£6,281 |

|

|

| |

60 |

£7,014 |

£6,666 |

|

|

| |

65 |

£7,652 |

£7,219 |

|

|

| |

70 |

£8,619 |

£7,918 |

|

|

£100,000 purchase, level rates, standard

Unisex rates and joint life basis |

|

|

|

|

|

| |

Plan your annuity and get quotes from the 12 leading providers |

|

| |

| |

|

Free Annuity Quotes |

| |

|

No Obligation |

| |

|

From All Providers |

|

|

|

|

|

|

|

|

|

| You can follow the latest annuity updates on Twitter or as a fan on Facebook |

|

| |

|

|

|

|

|