|

| 23 July 2014 last updated |

|

| Enhanced annuities fall as Ukraine crisis sends yields to new low |

|

Providers of enhanced annuities have reduced rates by as much as 1.6% as gilt yields react to the developing crisis in East Ukraine after the downing of Malaysian Airlines.

The 15-year gilt yields reduced to their lowest level for the year of 3.01% a fall of 10 basis points after the downing of Malaysian Airlines flight MH17.

The uncertainty over the incident and threat of sanctions against Russia for their support of the Pro-Russian

Separatists has sent investors to seek safe havens such as US Treasury bonds or UK government bonds and gilts.

As a general rule a 10 basis point fall in yields will result in a 1.0% decrease in annuity rates.

Enhanced annuities have been reduced by Partnership and Liverpool Victoria by up to 1.6%

and pressure is mounting on standard annuity providers.

Rates have been increased for standard annuities recently as yields reached 3.19%.

|

|

|

| |

Enhanced rates are 1.6% lower as yields fall after Ukraine crisis threatens new sanctions |

|

|

|

| |

|

Annuity rates at risk of going lower

Enhanced annuity rates closely follow the change in yields and have already corrected the recent fall. However, standard rates increased last month by 0.56% and are now looking high.

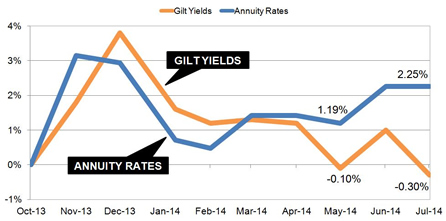

The following chart shows the strong correlation between gilt yields and annuities since October 2013.

|

| Fig 1: Chart comparing annuity rates and 15-year gilt yields |

The chart shows how the yields have reduced and are now 0.30% lower than the level in October 2013 whereas annuities are 2.25% higher.

Compared to the beginning of the month yields have reduced 13 basis points although at that time rates could have improved another 0.24% so this would suggest a 1.06% reduction for annuities is possible.

For our benchmark example a person aged 65 with a fund of £100,000 could have purchased a single life, level annuity with an income of £6,143 pa. A 1.06% fall would reduce the rate to £6,078 pa or back to where they were

After falling to a low for the year of £6,037 pa in February annuity rates had been slowly recovering after reaching a recent high in November 2013 for our benchmark example of £6,196 pa.

It is likely the recent uncertainty will subside once the US and Europe clarify the extent of sanctions on Russia and if so gilt yields could recover to support the current level for standard rates and see enhanced and impaired annuity rates recover the 1.6% recent losses.

|

|

|

|

|

|

|

|

| |

Age |

Single |

Joint |

|

|

| |

55 |

£6,654 |

£6,281 |

|

|

| |

60 |

£7,014 |

£6,666 |

|

|

| |

65 |

£7,652 |

£7,219 |

|

|

| |

70 |

£8,619 |

£7,918 |

|

|

£100,000 purchase, level rates, standard

Unisex rates and joint life basis |

|

|

|

|

|

| |

Plan your annuity and get quotes from the 12 leading providers |

|

| |

| |

|

Free Annuity Quotes |

| |

|

No Obligation |

| |

|

From All Providers |

|

|

|

|

|

|

|

|

|

| You can follow the latest annuity updates on Twitter or as a fan on Facebook |

|

| |

|

|

|

|

|