|

27 February 2015 last updated

|

|

| Impaired annuity rates up 3.5% after recovery in gilt yields |

|

Providers of impaired annuity rates have increase their rates by up to 3.5% as the 15-year gilt yields recover 47 basis points to end at 2.15% although providers of smoker and standard annuities have been slow to react.

Leading the rise in impaired annuities is Just Retirement with rates higher by up to 3.5% followed by Partnership and Liverpool Victoria. MGM have greater margins and all providers are improving rates as yields rise.

Rates are mainly based on the 15-year gilt yields and a 47 basis point rise would normally result in annuities rising by 4.7%.

Providers of impaired annuity rates such as Just Retirement can adjust their rates daily while other providers such as Partnership and Liverpool Victoria usually take a week to make changes.

In addition the FTSE-100 index had reached a new high which will mean more income for those that remain invested before buying their annuities.

|

|

|

| |

Providers of impaired annuities have increased rates by 3.5% as yields recover earlier losses |

|

|

|

| |

|

Smoker and standard providers slow to react

Despite the positive reaction from providers of impaired rates, standard rate providers are yet to follow. Their rates have been reducing since July 2014 although there is now pressure for them to make some improvements.

|

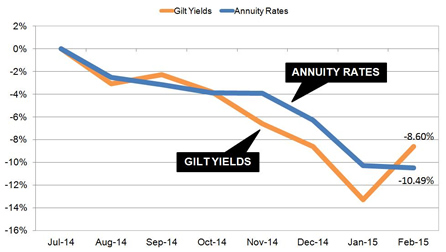

| Fig 1: Chart comparing annuity rates and 15-year gilt yields |

The above chart shows the 15-year gilt yields have recovered from from an all time low compared to annuities from last summer. As rates have been tracking yields lower over this period it suggests providers of smoker and standard are set to raise rates as with the impaired providers.

For our benchmark example for a person aged 65 with a fund of £100,000 could have purchased a single life, level annuity with an income of £5,494 pa. If standard annuities rise by 4.7% this would increase rates by £258 pa to £5,752 pa.

In terms of lifetime income, the Office of National Statistics (ONS) would expect a male to live for 17.3 years and he will have £4,463 more over his lifetime. For a female she can expected to live for 20.4 years increasing her income by £5,263.

Equity markets boost pension funds

A rise in annuity rates would be boosted for anyone that remains invested tracking the FTSE -100 index before buying their annuity. Since reaching a low for the year in January of 6,367, the index has increased 592 points to a new high of 6,959 up 9.29%.

This would add directly to income an annuity can offer and for anyone buying an annuity they would benefit from this extra for their lifetime. The last time the FTSE-100 index was at this level was back in December 1999 during the dotcom bubble. Markets were buoyant after the Greece had agreed terms from their creditors after weeks of uncertainty.

|

|

|

|

|

|

|

|

| |

Age |

Single |

Joint |

|

|

| |

55 |

£6,654 |

£6,281 |

|

|

| |

60 |

£7,014 |

£6,666 |

|

|

| |

65 |

£7,652 |

£7,219 |

|

|

| |

70 |

£8,619 |

£7,918 |

|

|

£100,000 purchase, level rates, standard

Unisex rates and joint life basis |

|

|

|

|

|

| |

Plan your annuity and get quotes from the 12 leading providers |

|

| |

| |

|

Free Annuity Quotes |

| |

|

No Obligation |

| |

|

From All Providers |

|

|

|

|

|

|

|

|

|

| You can follow the latest annuity updates on Twitter or as a fan on Facebook |

|

| |

|

|

|

|

|