|

31 October 2014 last updated

|

|

| Pension annuities remain unchanged as Fed stimulus is ended |

|

Pension annuities have remained unchanged as the Federal Reserve ends their stimulus package called Q3 or quantitative easing begun in 2008, which no longer impacts the direction of gilt yields leaving rates unchanged.

When the Federal Reserve announced it was ending Q3 in June 2013 the 15-year gilt yields soared 39 basis points in only three days with the potential of annuity rates rising 8% the following month.

The Fed had been buying $85 billion of bonds each month sending the price high and the yields down so by stopping this package yields would increase along with annuities.

Gilt yields continued to rise as the Fed tapered the stimulus package until reaching a high of 3.47% in January 2014.

Since then yields have dropped back as investors had accounted for the Fed's actions and other economic factors become more important, such as global growth and future interest rates rise.

|

|

|

| |

Federal Reserve ends the $85 billion a month stimulus with no change from annuities |

|

|

|

| |

|

Fed tapering had initial impact on yields

Annuity rates are based on the 15-year gilt yields and a 10 basis point increase would typically result in rates rising by 1.0%.

After the financial crisis there was a trend for investors to move their investments with approximately $600 billion moving from equities and $800 billion into safe havens such as US Treasury notes and UK government bonds and gilts.

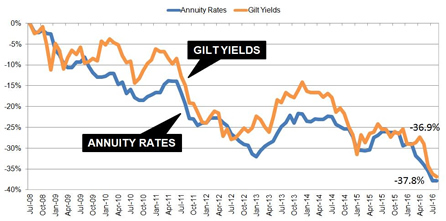

The markets have expected a reversal called the great rotation where funds would move out of bonds and gilts back into equities thereby reducing the price and increasing the yield. This partially occurred after June 2013 as shown in the following chart.

|

| Fig 1: Chart comparing annuity rates and 15-year gilt yields |

As the Federal Reserve planned to taper quantitative easing investors expected bond prices to fall, which they did, sending yields higher by 39 basis points to a high of 3.08% in June 2013.

Yields have reduced since start of tapering

Yields continued to increase reaching a high of 3.47% at the end of December 2013, just after the Fed reduced the stimulus by $10 billion to $75 billion per month. Markets had by now discounted the effect of a world with no stimulus. This was a significant improvement of 145 basis points compared to the all time low of 2.02% reached in August 2012.

After this yields have continued to fall until reaching a low of 2.42% in mid October eliminating the effect of tapering and other factors have been more important to the market than quantitative easing. Annuity rates reached their recent peak at a similar time as yields and have have since reduced.

Markets have now turned their attention to the low level of inflation in the US of 1.7% and in Europe and the possibility of interest rates rising with economic improvements. This would have a more significant impact on improving annuity rates in the future.

|

|

|

|

|

|

|

|

| |

Age |

Single |

Joint |

|

|

| |

55 |

£6,654 |

£6,281 |

|

|

| |

60 |

£7,014 |

£6,666 |

|

|

| |

65 |

£7,652 |

£7,219 |

|

|

| |

70 |

£8,619 |

£7,918 |

|

|

£100,000 purchase, level rates, standard

Unisex rates and joint life basis |

|

|

|

|

|

| |

Plan your annuity and get quotes from the 12 leading providers |

|

| |

| |

|

Free Annuity Quotes |

| |

|

No Obligation |

| |

|

From All Providers |

|

|

|

|

|

|

|

|

|

| You can follow the latest annuity updates on Twitter or as a fan on Facebook |

|

| |

|

|

|

|

|