|

23 March 2015 last updated

|

|

| Pension income higher as FTSE-100 index reaches all time high |

|

The FTSE-100 index reached a new all time high of 7,037 is a boost for pension income for people retiring now and follows a more cautious tone from the Federal Reserve about raising interest rates.

The FTSE-100 index reached a low for the year in january of 6,388 and has recovered strongly to reach a new high after the Fed is now more cautious about raising interest rates. This is due to a downgrade of the growth outlook and slashed inflation projections.

The improving markets increases the pension fund for people that remain invested before they retire and track the FTSE-100 index which directly improves the income they can take from their fund using a pension annuity or flexi-access drawdown.

For those buying an annuity rates reduced to a low for the year following 15-year gilt yields falling to 1.68% in January. Yields had recovered strongly to 2.32% but are are falling again. With new pension rules from April many people are considering alternatives to annuities.

|

|

|

| |

FTSE-100 index reaches an all time high of 7,037 increasing pension income at retirement |

|

|

|

| |

|

FTSE-100 gains counter poor annuity rates

Since June last year annuity rates have been on a downward trend with our benchmark example for a person aged 65 with a fund of £100,000 on a single life level basis reducing from £6,143 pa to the current level of £5,618 pa.

Most people remain invested in equities before taking their benefits and for those that track the FTSE-100 index the fall in annuity rates has been countered by the new all time high.

|

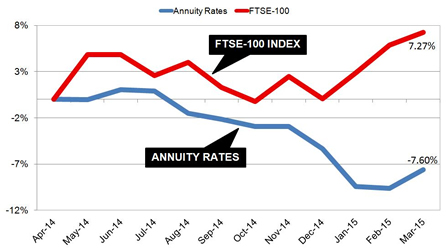

| Fig 1: Chart comparing annuity rates and FTSE-100 index |

The above chart shows the dramatic difference over the last year where annuity rates are down by 7.6%. This has been countered by a buoyant equities market which has increased by 7.27%.

Any increase in a pension fund will directly increase the income from an annuity. For someone investing in flexi-access drawdown they would find that they could take a higher income or leave the gain to grow in their pension fund.

How to delay buying an annuity

From April 2015 new pension rules mean you no longer have to buy an annuity. Annuity rates remain at all time lows but you can take an income and delay buying an annuity using a flexible income plans.

A flexi-access drawdown changes your pension into a type of pensions savings account allowing you to take your tax free lump sum now and leave the remaining fund invested, take an income, a lump sum or even contribute to the fund.

To reduce the risk of volatility new product innovations offer smoothed growth funds which

take the expected annual growth and divides this by 365 days, adding this to your fund on a daily basis.

For a very low risk option a fixed term annuity offers terms of three year or more with an income selected by you and a guaranteed maturity amount at the end. When the term ends you can consider all options again such as an annuity from any provider, flexi-access drawdown, taking the fund as cash or any other option available at that time.

|

|

|

|

|

|

|

|

| |

Age |

Single |

Joint |

|

|

| |

55 |

£6,654 |

£6,281 |

|

|

| |

60 |

£7,014 |

£6,666 |

|

|

| |

65 |

£7,652 |

£7,219 |

|

|

| |

70 |

£8,619 |

£7,918 |

|

|

£100,000 purchase, level rates, standard

Unisex rates and joint life basis |

|

|

|

|

|

| |

Plan your annuity and get quotes from the 12 leading providers |

|

| |

| |

|

Free Annuity Quotes |

| |

|

No Obligation |

| |

|

From All Providers |

|

|

|

|

|

|

|

|

|

| You can follow the latest annuity updates on Twitter or as a fan on Facebook |

|

| |

|

|

|

|

|