|

10 December 2018 last updated |

|

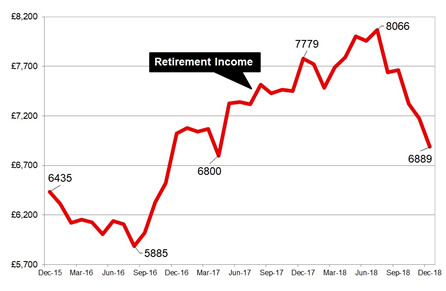

| Retirement income down 14% with falls in equity and gilt yields |

|

Recent Brexit turmoil has sent investors to the safety of gilts and bonds combines with volatility in global equity markets results in retirement income down 14.5% since the highs reached in the summer.

A combination of falling equities and annuity rates have combined to reduce the retirement income for those that remain invested

by tracking the FTSE-100 index before they take their benefits.

Based on our benchmark example of a 65 year old with a fund of £100,000 in July 2008 where an income was £7,908 pa, incomes reached a recent low of £5,885 pa in August 2016.

This recovered to a recent high in July 2018 of £8,066 pa and retirement income has now reduced to £6,889 pa for December 2018.

In October equity markets around the world reduced with about $5 trillion in value wiped from the global stock markets due to geopolitical uncertainty and with Brexit the risk of a no deal has seen investors seek out the safety of gilts and bonds.

|

|

|

| |

Brexit and geopolitical uncertainty reduces income for those that remain invested at retirement |

|

|

|

| |

|

Gilt yields reduce to 1.37% this month

The 15-year gilt yields have reduced 26 basis points this month from 1.63% at the start of the month to 1.37% as there is a greater risk that parliament will reject the Brexit deal negotiated by Prime Minister Theresa May.

As a general rule a 26 basis point fall in yields would result in a 2.6% fall in annuity rates. Providers are likely to maintain rates in the short term in anticipation of a recovery in yields should the current concern over a Brexit no deal subside.

|

| Fig 1: Chart comparing retirement income from 2015 to 2018 |

The above chart shows retirement income figures from December 2015 to 2018 is based on a 65 year old with £100,000 invested in a fund that tracks the FTSE-100 index and buying a single life, level annuity.

The start date for the data is July 2008 where an annuity income was £7,908 pa for £100,000 and since then equities and annuity rates have moved with the resulting changes in retirement income.

Since reaching a high of £8,066 pa in July 2018 retirement income has reduced by £1,177 pa or 14.5% in the last five months. If you are invested in cash you are protected from this uncertainty.

Since this date annuity rates have reduced only £70 pa or 1.2% from £5,633 pa to £5,563 pa with resistance from providers to lower rates for both standard and impaired annuities. In contrast the biggest impact is the fall in equities with the FTSE-100 index falling 1,047 points or 13.5% from 7,748 to 6,701.

Brexit may be the focus at the moment, however, other geopolitical factors have longer term implications for equities and bonds such as the trade tariffs between China and the US.

Markets are sensitive to issues related to the trade talks such as the recent arrest of Meng Wanzhou, Chief Financial Officer of telecoms giant Huawei started the fall in the Dow Jones index last Friday down 785 points in a day before it recovered down only 79 points.

It is this volatility that will make taking benefits at retirement difficult where funds remain invested although short term recovery in fund values are possible for people that can delay buying an annuity immediately.

|

| |

|

|

|

|

|

|

|

| |

Age |

Single |

Joint |

|

|

| |

55 |

£6,654 |

£6,281 |

|

|

| |

60 |

£7,014 |

£6,666 |

|

|

| |

65 |

£7,652 |

£7,219 |

|

|

| |

70 |

£8,619 |

£7,918 |

|

|

£100,000 purchase, level rates, standard

Unisex rates and joint life basis |

|

|

|

|

|

| |

Plan your annuity and get quotes from the 12 leading providers |

|

| |

| |

|

Free Annuity Quotes |

| |

|

No Obligation |

| |

|

From All Providers |

|

|

|

|

|

|

|

|

|

| You can follow the latest annuity updates on Twitter or as a fan on Facebook |

|

| |

|

|

|

|

|