|

| 4 December 2015 last updated |

|

| Impaired providers reduce rates beyond the fall in yields |

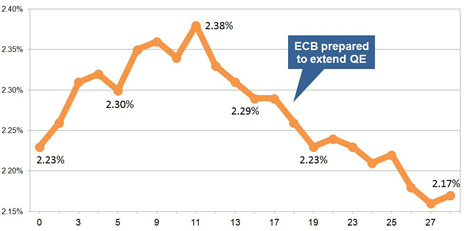

| 15-year gilt yields chart |

| Based on figures for November 2015 |

|

| |

Providers of impaired annuities have reduced their rates by up to 6% in the month beyond the fall in 15-year gilt yields ahead of EU Solvency 2 legislation starting in january 2016.

| Standard rates: |

|

|

0.46% |

|

| Enhanced rates: |

|

|

1.90% |

|

| Gilt yields: |

|

|

6 basis point |

|

|

|

|

| Impaired rates 6% lower ahead of Solvency 2

For the fifth month in a row providers of impaired annuities have reduced rates and during the month of October by an average of 1.9%. For some specific medical conditions, ages and annuity features from Just Retirement, Liverpool Victoria and Partnership rates are lower by up to 6%.

Although the 15-year gilt yields have reduced by only 6 basis points, impaired, enhanced and smoker rates are significantly lower.

Providers are using the Solvency 2 legislation as a reason for further falls in rates. Solvency 2 requires providers to strengthen their balance sheets by retaining more capital to protect policyholders from future uncertainty.

Standard providers lowered rates by

0.46% and we would expect to see a annuities to reduce by a further 1.90% in the long term.

Smoker and enhanced annuity providers decreased their rates by 1.90% on average and in the long term rates may rise by 0.2%.

Equity markets started at 6,361 and decreased by 5 points to end at 6,356.

Fig 1 below shows the annuity rates changes for the whole market and the proportion that have either increased, decreased or or did not change. It also shows the range of the changes of the annuity rates over the last month:

| Annuity Rates Changes |

| Increase |

No change |

Decrease |

|

|

32% |

|

|

|

|

7% |

|

|

|

|

61% |

|

|

Increases of:

up to 3.8%

|

|

Decreases of:

up to 6.0% |

|

| |

Fig 1: Annuity rate changes for the whole market |

|

The majority of rates increased with 32% rising, 7% remaining unchanged and 61% decreasing.

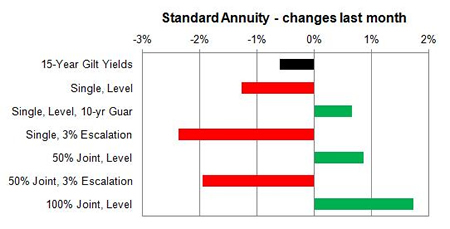

What happened to standard rates

Below shows a fund of £100,000 with the change in standard annuity rates for single and joint pensioners from age 55 to 75 with different annuity options such as level or escalating over 1 month compared to gilt yields:

|

| Fig 2: Change in standard rates last month compared to gilt yields |

Standard annuities was mixed with 40% of annuities reducing and 60% increasing. The highest increase of 3.8% was for 3% escalating, single life aged 55 although most escalating rates decreased. Annuities for 100% joint life and level all increased by an average of 1.7%. The largest decrease was 5.7% for level, single life aged 75.

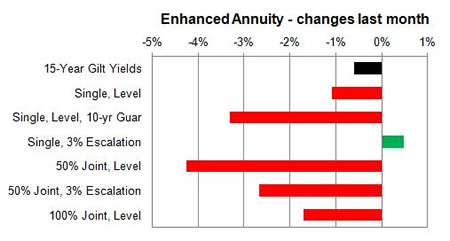

What happened to enhanced rates

Lifestyle smoker and enhanced annuities have decreased significantly across the board for all types of annuities and ages.

|

| Fig 3: Change in enhanced rates last month compared to gilt yields |

For enhanced and smoker providers rates virtually all rates decreased and in some cases significantly by up to 6%. The providers are reducing their rates ahead of the Solvency II legislation even though the changes have been expected for three years and rates have already been discounted over this time.

For the latest updates see Annuity Rates Review.

Changes to the 15-year gilt yields

The yields change for the month was from 2.23% to 2.17% or 6 basis points. Fig 2 below shows the daily 15-year gilt yields and the increase or decrease from the previous day's close:

| 15-Year Gilt Yields - November 2015 |

| Mon 2nd |

Tues 3rd |

Wed 4th |

Thurs 5th |

Fri 6th |

| 2.26% |

|

|

0.03 |

|

| 2.31% |

|

|

0.05 |

|

| 2.32% |

|

|

0.01 |

|

| 2.30% |

|

|

0.02 |

|

| 2.35% |

|

|

0.05 |

|

| Mon 9th |

Tues 10th |

Wed 11th |

Thurs 12th |

Fri 13th |

| 2.36% |

|

|

0.01 |

|

| 2.34% |

|

|

0.02 |

|

| 2.38% |

|

|

0.04 |

|

| 2.33% |

|

|

0.05 |

|

| 2.31% |

|

|

0.02 |

|

| Mon 16th |

Tues 17th |

Wed 18th |

Thurs 19th |

Fri 20th |

| 2.29% |

|

|

0.02 |

|

| 2.29% |

|

|

| 2.26% |

|

|

0.03 |

|

| 2.23% |

|

|

0.03 |

|

| 2.24% |

|

|

0.01 |

|

| Mon 23rd |

Tues 24th |

Wed 25th |

Thurs 26th |

Fri 27th |

| 2.23% |

|

|

0.01 |

|

| 2.21% |

|

|

0.02 |

|

| 2.22% |

|

|

0.01 |

|

| 2.18% |

|

|

0.03 |

|

| 2.16% |

|

|

0.01 |

|

| Mon 30th |

|

|

|

|

| 2.17% |

|

|

0.01 |

|

|

|

|

|

|

| |

Fig 2: Daily 15-year gilt yields and changes |

|

|

|

|

|

|

|

|

|

| |

Age |

Single |

Joint |

|

|

| |

55 |

£6,654 |

£6,281 |

|

|

| |

60 |

£7,014 |

£6,666 |

|

|

| |

65 |

£7,652 |

£7,219 |

|

|

| |

70 |

£8,619 |

£7,918 |

|

|

£100,000 purchase, level rates, standard

Unisex rates and joint life basis |

|

|

|

|

|

| |

Plan your annuity and get quotes from the 12 leading providers |

|

| |

| |

|

Free Annuity Quotes |

| |

|

No Obligation |

| |

|

From All Providers |

|

|

|

|

|

|

|

|

|

| You can follow the latest annuity updates on Twitter or as a fan on Facebook |

|

| |

|

|

|

|

|