|

| 31 December 2012 last updated |

|

| Annuity Rates - December 2012 |

Unisex annuity rates have increase for female and decrease for male rates as Gender Neutral pricing has been introduced

| Male rates: |

|

|

2.77% |

|

| Female rates: |

|

|

3.95% |

|

The EU Gender Directive introducing gender neutral pricing was implimented on 21 December bringing in new Unisex rates. Male rates have reduced by an average of 2.77% and female rates have increased by 3.95% on average.

During the month the 15-year gilt yields increased to 2.45% as a deal became likely over the US fiscal cliff that threatened to introduce $600 billion of spending cuts and tax rises from january 2013.

The fiscal cliff would risk the US returning to recession due to the extra taxes imposed on US citizens and there would be a knock on effect for the global economy. |

|

|

Annuity rates lower than expected

Find out more:

December analysis of gilt yields

unisex rates to lower pensioner income

solvency 2 will lower annuity rates by 2014

Annuity rates are primarily based on the 15-year gilt yields and the increase of 8 basis points should have seen rates increase by 0.8% this month. Taking into account the adjustments to male and female rates due to gender neutral pricing, UK standard annuities should increase by 0.48% in the short term and smoker rates increase by 0.99%.

Over a longer period of three months gilt yields increased by 1.30% whereas standard annuities are down by 1.44% which suggests there is potential for increases of 2.74%. For smokers pension annuity rates are lower by 3.47% so the potential increase even after the adjustment for female rates improving is 4.77%.

Fig 1 below shows the annuities changes for the whole market and the proportion that have either increased, decreased or or did not change. It also shows the range increases or decreases of the annuity rates over the last month:

| Annuity Rates Changes |

| Increase |

No change |

Decrease |

|

|

32% |

|

|

|

|

8% |

|

|

|

|

50% |

|

|

Increases of:

0.2% - 7.1%

|

|

Decreases of:

0.2% - 5.4% |

|

| |

Fig 1: Annuity rate changes for the whole market |

|

Fig 1 above shows that 32% of annuity rates increased for rates including standard and smoker. These increases were from 0.2% to 7.1% for all females and most 100% joint life annuitants. Of the 50% decreases all of these were male rates for both standard and smokers with the majority of joint life apart from those aged about 75 and 100% joint life.

Equity markets were slightly higher starting at 5,867 and ending at 5,898 up only 31 points. Pensioners still invested should have experienced slight increase in their pension fund when purchasing annuities during the month.

What happened to rates during December

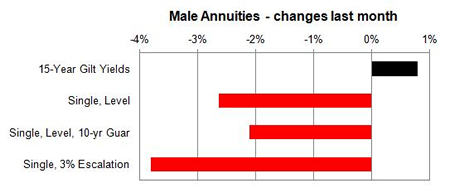

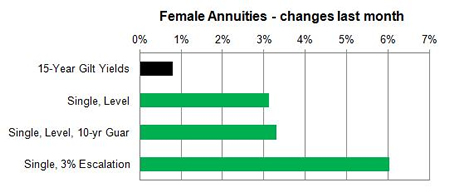

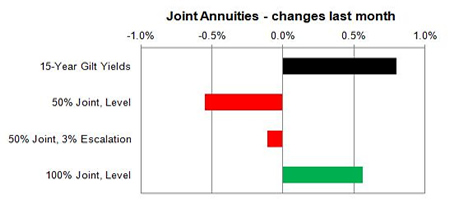

Below shows a fund of £100,000 with the change in standard annuity rates for males, females and joint from age 55 to 75 with different annuity options such as level or escalating over 1 month ending December 2012 compared to gilt yields:

|

| Fig 2: Change in male rates last month compared to gilt yields |

|

| Fig 3: Change in female rates last month compared to gilt yields |

|

| Fig 4: Change in joint rates last month compared to gilt yields |

The above tables are for standard annuities and based on changes to gilty yields in December or 8 basis points annuity rates should increase by 0.8%. The gender neutral pricing means the changes are more dramatic, however, a further analysis will be completed in a sharingpensions article to show the real winners and losers taking into account the changes that occured before Unisex annuity rates were implimented.

The largest fall is for males, single life and 3% escalation with decreases of 1.65% for those aged 75 to 5.46% for those aged 70 giving an average decrease of 3.81%. The largest fall in monetary terms with a fund size of £100,000 is for those aged 70 with a decrease in income of £269 pa from £4,928 pa to £4,659 pa. Based on the Office of National Statistics (ONS) he would be expected to live 14.0 years so the loss in pension annuity income would be a significant £5,003 over his lifetime.

For females the largest increase were based on single life and 3% escalation ranging from 4.65% to 7.18% for those aged 55 to 75. The largest increase in monetary terms with a fund size of £100,000 was for females aged 75 on a single, level basis with an increase in income of £367 pa from £7,068 pa to £7,435 pa. Based on the ONS she would be expected to live 18.6 years so the gain in annuity income would be £6,826 over her lifetime.

The EU Gender Directive has forced all annuity rates lower and this position will benefit provider profit margins while pensioners can expect poorer value for money than expected at this time. For the latest updates see Annuity Rates Review.

Impaired annuity rates have been reduced by providers during December and in particular by market leaders Liverpool Victoria, Partnershp Assurance and Just Retirement.

|

|

|

|

| |

Age |

Single |

Joint |

|

|

| |

55 |

£6,654 |

£6,281 |

|

|

| |

60 |

£7,014 |

£6,666 |

|

|

| |

65 |

£7,652 |

£7,219 |

|

|

| |

70 |

£8,619 |

£7,918 |

|

|

£100,000 purchase, level rates, standard

Unisex rates and joint life basis |

|

|

|

|

|

| |

Plan your annuity and get quotes from the 12 leading providers |

|

| |

| |

|

Free Annuity Quotes |

| |

|

No Obligation |

| |

|

From All Providers |

|

|

|

|

|

|

|

|

|

| You can follow the latest annuity updates on Twitter or as a fan on Facebook |

|

| |

|

|

|

|

|