|

| 21 July 2012 last updated |

|

| Unisex annuity rates to reduce annuities for males and couples |

|

From 21 December 2012 the EU Gender Directive will require annuity rates for men and women to be be the same and providers will have to offer unisex rates for all annuities.

In fact some providers have been offering unisex annuity rates before the ruling was made where pensions were protected rights, however, this market was small compared to the universal change this year.

The landmark judgment by the European Court of Justice (ECJ) was not directed at annuities but gender discrimination for the pricing of insurance and determined that the person's gender should not be used when setting prices so men and women will pay the same premiums.

The consequence for the UK is that annuity rates for men will decrease resulting in a lower pension for single and joint life pensioners with an increase in annuity rates for women. |

|

|

|

Annuity rates to decrease with Unisex rates

Although equality has been the basis of legal principles since the 18th century, EU directives had an exception for insurance premiums and benefits if based on actuarial and statistical data. The EU Gender Ruling will mean annuities can no take into account mortality differences between men and women which has resulted with women receiving lower annuity rates and therefore lower pension income as they live longer than men. This means males rates will decrease and female rates will increase.

The majority of annuities purchased are by males on a single life and joint life basis with a smaller number by females with their own pension funds purchasing annuities. This is due to the generation currently retiring being weighted towards the working male building up pension benefits although this is changing as more females have longer term careers. The reduction in males pension annuity rates is going to impact on single male pension incomes but also joint life annuities where a spouse will find she has less income for her lifetime if her husband dies first.

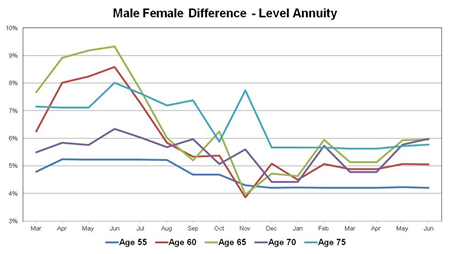

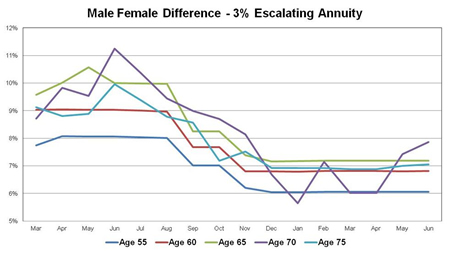

It is likely that males rates will reduce by a larger percentage than female rates will increase. The possible decrease can be seen in the following graphs that show the difference in income as a percentage between males and females for a fund of £100,000, single life and based on a level annuity and 3% escalating annuities.

The following table shows the difference in male and female level annuity rates from March 2011 to June 2012.

|

| Fig 1: Difference in male and female level annuity rates |

The following table shows the difference in male and female 3% escalating annuity rates from March 2011 to June 2012.

|

| Fig 2: Difference in male and female 3% escalating annuity rates |

The graphs compare ages of 55, 60, 65, 70 and 75 and shows after the ruling by the European Court of Justice in February 2011 the difference between annuity income for males and females increased significantly for some age groups and have since converged.

The percentage changes we can expect

For level annuities the pension income difference ranges from 4.2% for those aged 55 to 6.0% for those aged 65 and 70. On average it is likely that males and joint rates will reduce by between 2.5% to 3.6% from current levels. For female annuity rates it is likely these will increase between 1.7% to 2.4%.

For 3% escalating annuities the pension income difference is greater ranging from 6.0% for those aged 55 to 7.9% for those aged 70. On average it is likely that males and joint rates will reduce by between 3.6% to 4.7% from current levels. For female annuity rates it is likely these will increase between 2.4% to 3.1%.

This would mean that a male pensioner retiring with a fund of £100,000, aged 60 and buying a pension annuity on a level basis would receive an income of £5,358 pa and this would reduce by £160 pa to £5,198 pa. For a female aged 60 buying an annuity on a level basis the income would increase by £111 pa from £5,087 pa to £5,198 pa.

For pensioners with medical conditions that can benefit from higher rates from an enhanced or impaired annuity they can also expect the above decreases in income. For the whole market some 90% will purchase level annuities so the greater differences in the escalating rates will not be a significant impact overall.

Future for the guaranteed lifetime annuity

Unisex annuity rates will make the guaranteed lifetime annuity a less attractive option especially with the introduction of Solvency 2 from January 2014. If Solvency 2 reduces annuity rates by a further 8% the combined effect of both these EU measures could see males rates lower by up to 12% and female rates lower by up to 5%.

For pensioners with smaller pension funds

of under £50,000 there is still a place for the guaranteed lifetime annuity as security of income will be very important. For larger funds or smaller funds of under £50,000 where a pensioner has other retirement benefits such as an employers defined benefit scheme, other options such as investment linked or with profit pension annuities and fixed term annuities will offer an attractive alternative to generate the maximum possible income during the pensioner's lifetime.

|

|

|

|

|

|

|

|

| |

Age |

Single |

Joint |

|

|

| |

55 |

£6,654 |

£6,281 |

|

|

| |

60 |

£7,014 |

£6,666 |

|

|

| |

65 |

£7,652 |

£7,219 |

|

|

| |

70 |

£8,619 |

£7,918 |

|

|

£100,000 purchase, level rates, standard

Unisex rates and joint life basis |

|

|

|

|

|

| |

Plan your annuity and get quotes from the 12 leading providers |

|

| |

| |

|

Free Annuity Quotes |

| |

|

No Obligation |

| |

|

From All Providers |

|

|

|

|

|

|

|

|

|

| You can follow the latest annuity updates on Twitter or as a fan on Facebook |

|

| |

|

|

|

|

|