|

20 November 2020 last updated |

|

| Equity markets rise 14% as vaccines could end economic uncertainty |

|

| |

FTSE-100 index up 13.8% as drug companies announce successful Covid-19 vaccine tests. |

|

|

|

|

|

Equity markets rise globally with the FTSE-100 index up 13.8% on news of successful Covid-19 vaccine tests which could end the need for lockdowns and uncertainty for the economy.

The FTSE-100 Index started the year at a high of 7,674 only to fall to 4,933 on 23 March 2020 after the impact of the Coronavirus and a global lockdown was fully realised by the market. For those that remain invested before taking their benefits would find their fund is lower and less income available from pension annuities.

Markets started the month at 5,577 rising initially due to the outcome of the US Election with Joe Biden recognised as the President Elect.

With the Covid-19 vaccine announcement on 9 November by Pfizer and BioNTech of the stunning results from the trials of 41,000 volunteers worldwide with efficacy level higher than 90.0%, markets increased 13.8% or 774 and the FTSE-100 Index is at 6,351 by 20 November.

In addition drugs company Moderna with their vaccine produced efficacy levels of 94.5% and markets can see a possible end to the lockdowns that have caused global economic damage during 2020.

|

| |

FTSE-100 index and gilt yields |

|

| |

May |

Jun |

Jul |

Aug |

Sep |

Oct |

Nov |

| FTSE |

6,076 |

6,169 |

5,897 |

5,963 |

5,866 |

5,577 |

6,351 |

| Rate |

£4,920 |

£4,825 |

£4,843 |

£4,863 |

£4,848 |

£4,867 |

£4,867 |

|

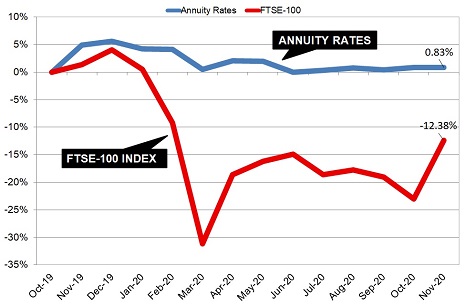

Fig 1: Chart and table comparing FTSE-100 Index and 15-year gilt yields |

The above chart shows the steep fall in the FTSE-100 index during February and March 2020 down 31.9% since October 2019 level of 7,248. The index has recovered and is now down 12.3% compared to a year ago.

Find related news here:

Annuity rates could rise as gilt yields bounce back with vaccine results

Annuities at risk with volatile gilts due to Covid-19 restrictions in Europe

Over the past year annuity rates are up slightly by 0.83% and have been particularly steady since the Coronavirus pandemic.

Markets remain cautious and may stay at current levels until further details are released concerning the distribution of vaccines and the rate of vaccinations for different countries. Further upward movement may occur with emergency authorisation from the Food and Drug Administration (FDA).

Production levels for 2021 could be high with drugs company Pfizer expecting to produce 1.3 billion doses and Moderna 1.0 billion although two doses are needed for each vaccination.

In the UK supply of 355 million doses has been secured from a number of different drugs companies including 40 million from Pfizer, 5 million from Moderna and 100 million from Oxford-AstraZeneca.

What this means for people that have delayed their retirement or are retiring in 2021 and remain invested is funds values could return to levels before the lockdown.

In many cases pension funds in managed portfolios are at or above pre-lockdown levels. For those accessing flexi-access drawdown taking a slightly lower level of income over the next year would allow their fund to recover

For older people in retirement if may also be possible to access tax free cash from their property using equity release. One of the consequences of the Coronavirus pandemic is lower interest rates and lifetime mortgages offer rates from 2.34% which can be paid as you go or allowed to roll-up over time. Unlike residential or retirement interest only mortgages these plans can be set-up without evidence of earnings.

|

|

|

|

|

|

|

| |

Age |

Single |

Joint |

|

|

| |

55 |

£6,654 |

£6,281 |

|

|

| |

60 |

£7,014 |

£6,666 |

|

|

| |

65 |

£7,652 |

£7,219 |

|

|

| |

70 |

£8,619 |

£7,918 |

|

|

£100,000 purchase, level rates, standard

Unisex rates and joint life basis |

|

|

|

|

|

| |

Plan your annuity and get quotes from the 12 leading providers |

|

| |

| |

|

Free Annuity Quotes |

| |

|

No Obligation |

| |

|

From All Providers |

|

|

|

|

|

|

|

|

|

| You can follow the latest annuity updates on Twitter or as a fan on Facebook |

|

| |

|

|

|

|

|