|

25 March 2020 last updated |

|

| Equity markets surge 15% as US Senate agrees $2 trillion stimulus package |

|

| |

FTSE-100 index rises almost 14% as the US Senate agrees a $2tn Coronavirus package |

|

|

|

|

|

Global equity markets have surged over 15% as the US Senate agree a $2 trillion stimulus package to lesson the economic impact of the Coronavirus on business and workers.

The FTSE-100 Index increases 13.9% in the last two trading days as the Senate negotiation over the past few days has resulted in a $2 trillion stimulus deal to protect US citizens and the economy from the spread of the Coronavirus.

Other indexes have increased with the German Dax up 12.7%, Japan Nikkei higher by 15.7% and the US Dow increasing 16.4% at 2pm (6pm GMT) on 25 March.

Find related news here:

Gilt yields fall as coronavirus threatens slowdown for global growth

Pension annuities risk as oil price fall sends yields to all time lows

Retirement income at decade low with panic selling on equity markets

The action follows the UK chancellor Rishi Sunak announcing the government would initiate radical funding measures with £330 billion of loans and £20 billion in other financial aid for UK citizens and businesses.

|

| |

FTSE-100 index and gilt yields |

|

| |

Sep |

Oct |

Nov |

Dec |

Jan |

Feb |

Mar |

| FTSE |

7,408 |

7,248 |

7,346 |

7,542 |

7,286 |

6,580 |

5,688 |

| Yield |

0.71% |

0.86% |

0.93% |

1.07% |

0.76% |

0.66% |

0.67% |

|

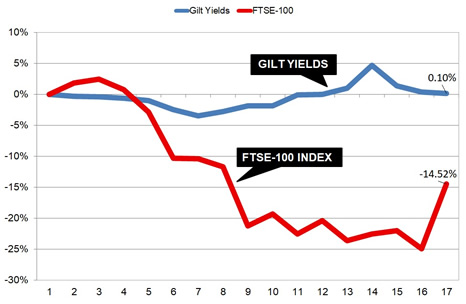

Fig 1: Chart and table comparing FTSE-100 Index and 15-year gilt yields |

The above chart shows that the FTSE-100 index reduced to a low point of 4,993 on 23 March 2020 having reduced -24.9% this month following falls starting on 21 February.

The surge of the index up 695 points in the last two trading days to 5,688 reduces the fall this month to -14.5% and there could be further positive news from Italy with the number of new daily Coronavirus cases reducing from 6,557 on 21 March to 5,249 three days later.

The 15-year gilt yields have been volatile reaching an all time low of 0.162% on the 9 March after investor fear of the economic impact of the Coronavirus on the global economy.

After governments announced plans for a stimulus package yields increased to 1.20% rising 104 basis points over 10 days as investors sold bonds and gilts to raise cash. Yields have since returned to more normal levels of 0.67% today.

Options for providing income

As annuities are based mainly on these yields and providers have been reducing annuity rates by on average -3.5% for March to date. Many people retiring now may not want to take pension benefits with lower annuity rates and pension values due to falling equity markets.

An option would be to consider flexi-access drawdown accessing some or all of the tax free lump sum and take income in the short term. This would delay the need to commit the full fund to buying an annuity when retirement income is at such a low level an locking into a lifetime annuity.

As an alternative people can access their savings in the short term or you could release equity as a tax free lump sum from your property using a lifetime mortgage to provide an income. This would allow your pension fund to recover in the medium term with the prospect of higher annuity rates due to being older.

Interest rates for lifetime mortgages are as low as 2.65% pa which you can pay as you go or roll-up over time and unlike a residential mortgage, no evidence of earnings is required to set-up the plan.

|

|

|

|

|

|

|

| |

Age |

Single |

Joint |

|

|

| |

55 |

£6,654 |

£6,281 |

|

|

| |

60 |

£7,014 |

£6,666 |

|

|

| |

65 |

£7,652 |

£7,219 |

|

|

| |

70 |

£8,619 |

£7,918 |

|

|

£100,000 purchase, level rates, standard

Unisex rates and joint life basis |

|

|

|

|

|

| |

Plan your annuity and get quotes from the 12 leading providers |

|

| |

| |

|

Free Annuity Quotes |

| |

|

No Obligation |

| |

|

From All Providers |

|

|

|

|

|

|

|

|

|

| You can follow the latest annuity updates on Twitter or as a fan on Facebook |

|

| |

|

|

|

|

|