|

2 December 2015 last updated

|

|

| Impaired annuities lower by up to 6% ahead of Solvency 2 start date |

|

Impaired annuity providers are using Solvency 2 as a reason to reduce rates by up to 6% ahead of the new legislation start date of 1 January 2016 even though enhanced rates are back to gilt yield levels.

Providers of impaired annuities such as Just Retirement, Liverpool Victoria and Partnership are reducing their rates and in some case by up to 6% in the last month.

Enhanced annuities have already reduced since reaching a high during the summer and have continually fallen back to match changes in the 15-year gilt yields.

Providers are using the Solvency 2 legislation as a reason for further falls in rates even though the changes have been expected for three years with the opportunity to discount rates over this time.

Solvency 2 requires providers to strengthen their balance sheets by retaining a regulatory as well as surplus capital to protect policyholders from future uncertainty. Requirements have been reduced since it was first proposed back in 2012.

|

|

|

| |

Impaired providers warn of a fall in rates due to the changes expected with Solvency 2 legislation |

|

|

|

| |

|

Impaired rates tumble lower

Enhanced annuity rates reached a high in June and have since decreased five months in a row down 5.37% on average. Providers of impaired annuities are now reducing rates further with some specific medical conditions, ages and annuity features from Just Retirement, Liverpool Victoria and Partnership are lower by up to 6% in the last few weeks.

|

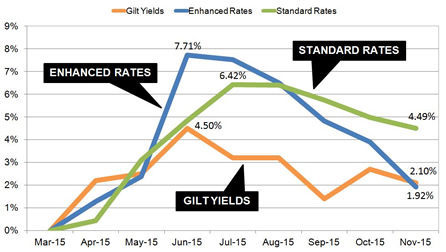

| Fig 1: Chart comparing annuity rates and and gilt yields |

The above chart shows the 15-year gilt yields were at 1.96% in march. Since then yields increased 45 basis points to 2.41% with annuity rates continuing to rise during the summer.

Enhanced

annuities increased by 7.71% and standard rates by 6.42% offering better value than expected. However, since then enhanced rates have reduced back to the yields level. In contrast standard annuities are offering better value at the moment.

Impact of Solvency 2 changes

The original plan was to introduce Solvency 2 form December 2012 but due to the complexity of the EU Directive and the number of member states involved the process of consultation has been delayed.

The new start date is 1 January 2016 and the three year delay should have given annuity providers time to adjust their rates.

Solvency 2 takes a different view to insurance companies considering them as a 'going concern' with the assumption they will continue to operate and write business for the foreseeable future.

A significant change is regarding the amount of capital insurance companies retain on their balance sheets including new regulatory and surplus capital requirements. to protect policyholders from future uncertainty.

In addition Solvency 2 measures the quality of capital as even if the quantity is sufficient the company may still not be able to absorb losses in the future.

As a result of the above changes providers may continue to reduce their rates to strengthen their future balance sheets and the smaller impaired providers such as Just Retirement, Liverpool Victoria and Partnership may need to do more than the larger standard annuity providers, such as Canada Life and Aviva.

|

|

|

|

|

|

|

|

| |

Age |

Single |

Joint |

|

|

| |

55 |

£6,654 |

£6,281 |

|

|

| |

60 |

£7,014 |

£6,666 |

|

|

| |

65 |

£7,652 |

£7,219 |

|

|

| |

70 |

£8,619 |

£7,918 |

|

|

£100,000 purchase, level rates, standard

Unisex rates and joint life basis |

|

|

|

|

|

| |

Plan your annuity and get quotes from the 12 leading providers |

|

| |

| |

|

Free Annuity Quotes |

| |

|

No Obligation |

| |

|

From All Providers |

|

|

|

|

|

|

|

|

|

| You can follow the latest annuity updates on Twitter or as a fan on Facebook |

|

| |

|

|

|

|

|