|

| 15 January 2013 last updated |

|

| Unisex annuity rates for females the winners and losers |

The EU Gender Directive introduced Unisex annuities in December with males rates lower and female rates higher but with further analysis virtually all annuity rates have reduced when compared against the 15-year gilt yields.

The 15-year gilt yields reached an all time low of 2.02% in August 2012 and by the end of the month UK annuity rates had reduced to reflect the fall in gilts.

From this time gilt yields increased right up to the end of the year and under normal circumstances pension annuities would have followed but in fact providers of standard, smoker and impaired rates were locked in a downward pricing cycle and reduced all rates instead.

This fall was mainly due to the EU Gender Directive implementing the Unisex annuity rates on 21 December 2012 which was accelerated as the deadline approached and providers reduced rates to stem the flow of pensioners buying annuities.

|

|

|

Few females received actual income increases

After the low of August 15-year gilt yields actually increased by 24 basis points by the end of December and as a general this would mean annuity rates should increase by 2.4%. Instead standard annuities reduced by an average of 2.27% and smoker rates by an average of 3.60% over this medium term although the impression is that all female rates increased in December which is true, but only after significant falls in the previous months.

Based on the following charts, female rates should have been higher by 2.4% on average due to gender neutral pricing and higher by 2.4% for the rise in gilt yields or a total of about 4.8%. No females achieved this and only a very small percentage aged over 70 came close.

Standard annuities for females

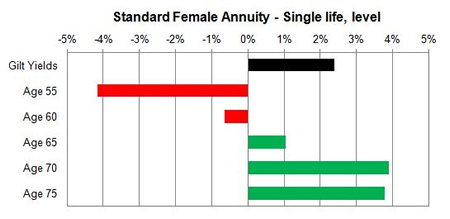

The following chart shows how the annuity rates for a female with a fund of £100,000 buying a single life, level annuity changed from August 2012 to December 2012.

|

| Fig 1: Level annuity changes August to December compared to gilts |

The general expectation for gender neutral pricing was that male rates would decrease by up to 3.6% and female rates would increase by up to 2.4%. Bearing in mind that approximately 98% of annuities are purchased between the ages of 55 to 65, only a tiny proportion of 2% aged over 70 would have benefited more than the rise in gilt yields.

The majority of females aged 55 to 65, with about 90% purchasing level annuities, actually experienced a decrease of as much as 4.16% and the best increase was only 1.04%. Only those aged 70 and over experienced greater increases of up to 3.91%, still lower than expected.

The largest decrease for a 55 year old based on a fund of £100,000 would see incomes fall by £189 pa from £4,546 pa to £4,357 pa. The Office for National Statistics (ONS) expects her to life for 29.1 years and over her lifetime she will receive £5,501 less income.

|

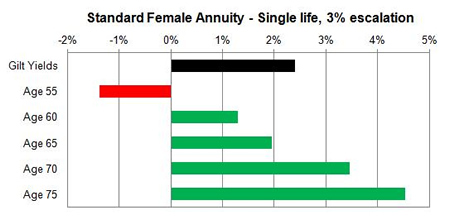

| Fig 2: Escalating annuity changes August to December compared to gilts |

Only about one in ten people would select escalation and although the providers were more generous it was only those aged over 70 that have benefited with an above expected increase.

Smoker annuities for females

Smokers were subject to even more aggressive price cutting by the pension annuity providers with none benefiting from gender neutral pricing at all.

|

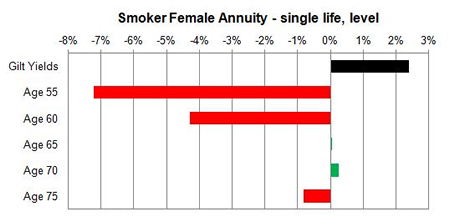

| Fig 3: Smoker level changes August to December compared to gilts |

For female smokers with a fund of £100,000 on a single, level basis aged 55, they experienced a decrease in annuity rates of 7.22% and those aged 60 also had a decrease of 4.28%.

We were expecting increase of up to 2.4% due to gender neutral pricing and another 2.4% due to an increase in gilt yields, making a total expected increase of 4.8%.

The largest decrease for a 55 year old based on a fund of £100,000 would see incomes fall by £378 pa from £5,235 pa to £4,857pa.

|

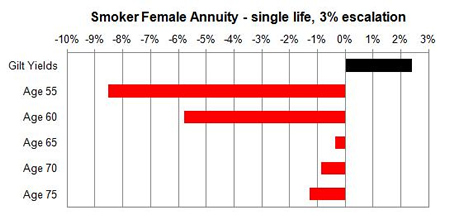

| Fig 4: Smoker escalating changes August to December compared to gilts |

The figures for an escalating annuity is even more extreme with females aged 55 experienced a decrease in annuity rates of 8.53% and those aged 60 also had a decrease of 5.79%. The rates for males and joint life annuities decreased over this period of time being lower by 2.43% to 9.01% with tiny increases of 0.53% for those aged 75 or older. See Annuity Rates Review for for information on the latest changes.

|

|

|

|

|

|

|

|

| |

Age |

Single |

Joint |

|

|

| |

55 |

£6,654 |

£6,281 |

|

|

| |

60 |

£7,014 |

£6,666 |

|

|

| |

65 |

£7,652 |

£7,219 |

|

|

| |

70 |

£8,619 |

£7,918 |

|

|

£100,000 purchase, level rates, standard

Unisex rates and joint life basis |

|

|

|

|

|

| |

Plan your annuity and get quotes from the 12 leading providers |

|

| |

| |

|

Free Annuity Quotes |

| |

|

No Obligation |

| |

|

From All Providers |

|

|

|

|

|

|

|

|

|

| You can follow the latest annuity updates on Twitter or as a fan on Facebook |

|

| |

|

|

|

|

|